Weekly newsletter for women who want to be smart about money: financial news, personal finance and investing

Welcome to our #31 weekly newsletter in 2020.

Every week we curate key content and apply a female-lens so you can stay informed and inspired about money and investing.

Stay in the know.

Keep on top of global economic, financial and investing news and trends. And read about what this means for you and your money in 2020 during Covid-19 and beyond.

If you’re short on time, listen to the editorial on audio for a brief overview.

“Our mission is to help women take control of their financial future”

-Jana Hlistova

Photo: Christina @ wocintechchat.com

From The Purse…

Editorial from the Founder

Globally countries are dealing with an increase in Covid cases.

Whether this is Hong Kong, Australia or the UK, countries around the world are having to manage regional outbreaks or a second wave.

This week, hopes for a short lockdown with a V-shaped recovery were dashed. It is believed now that a vaccine or a medical breakthrough is necessary before economies can fully recover.

On Wednesday, Jay Powell, the Chairman for the Federal Reserve, said that Covid will impact economic recovery in the US and that ‘we’ve got to hope for the best and plan for the worst’.

The US economy shrunk by -32.9% (annualised) in Q2 and the Eurozone declined by a record 12.1%.

UK economic recovery is underway but concerns for job losses continue: closing the furlough scheme in the autumn could drive unemployment to 3m by Christmas.

According to think tank, EY Item Club, the UK economy will not fully recover until 2024.

Meanwhile shares in Kodak surged 2,441%, sending its market cap close to $2bn. The US government loaned the camera making firm $765m to help produce ingredients in key generic medicines to fight Covid-19. Crony capitalism? Probably.

Big tech is eating the world and we spotlight what this means for investors-especially if you’ve invested in the S&P 500.

In the Have You Seen This? section, read about women’s wealth in the US and why it will triple to $30tn within a few years. The UK economy is missing out on £47bn due to a lack of women in senior leadership.

And read about the hidden ways companies are paying women unfairly.

We’re tracking a US start-up, LOOM, co-founded by a black female founder who has just raised $3m in seed funding.

Check out Martha Brook, the personalised productivity startup and their crowdfunding campaign.

And listen to our podcast interview with Vicki Saunders, an entrepreneur and a leading advocate for entrepreneurship as a way of creating positive transformation in the world. We talk about radical generosity and the women working on the world’s to-do list. You can also listen here.

Stay safe, look after yourselves and your loved ones.

I hope you enjoy this week’s newsletter. Until next week,

Jana

The Big Picture

Global markets and economy news, trends and indicators

The Coronavirus Effect:

Globally, countries are dealing with an increase in the number of Covid cases

Whether it is Hong Kong, Australia, Germany or the UK, countries around the world are dealing with either regional outbreaks or a second wave.

This week, hopes for a short lockdown followed by for a V-shaped recovery ended. A vaccine or a medical breakthrough is needed before economies can fully recover.

US: Donald Trump rattled the stock markets after he suggested he might delay the November election

The US economy contracted -32.9% (annualised) in Q2 vs the expected -34.7%.

According to Deutsche Bank, this was not the worst GDP decline in US history. The worst GDP decline was -42.3% in Q1 1946.

The US GDP decline is alarming but ‘self-inflicted’ due to the pandemic lockdown.

The Eurozone shrunk by a record 12.1% in Q2

The data shows that this contraction wiped out more than a decade of expansion. Also:

New Covid cases, increase the risk of reversed re-openings.

An increase in unemployment, bankruptcies and weak investment means that recovery will be slow.

Economists predict a 8% fall in output: this may be the deepest recession for the bloc since it was established.

US: the Federal Reserve keeps interest rates the same and Covid will impact economic recovery

In their meeting Wednesday, Jay Powell, the Chairman for the US central bank, said that ‘we’ve got to hope for the best and plan for the worst’.

The Fed also said that Congress negotiating a new stimulus package ‘is a good thing’.

UK economic recovery is underway but job loss concerns continue

Closing the furlough scheme in autumn could drive unemployment to 3m by Christmas. As many as 9.5 million jobs have been furloughed since March.

Record inflows into gold ETFs and the US price of gold up 17% in H2

Investors unnerved by economic uncertainty, central banks printing money, rising Covid cases and the tension between the US and China, ‘flee to gold’.

Future Focus

Keeping an eye on key predictions, innovations and what’s going to impact the future

UK: full economic recovery by 2024

EY Item Club predicted that UK’s economic recovery will be delayed by a further 18months.

They predict the UK economy will contract by 11.5% (not by 8% as initially forecast).

In May, the average UK household’s income dropped by 4.5%.

UK’s biggest pension fund begins fossil fuel divestment

National Employment Savings Trust (Nest, with 9m members) will begin divesting in firms involved in coal, tar sands or arctic drilling.

The fund will shift £5.5bn into ‘climate aware’ investments as it anticipates a green economic recovery from coronavirus.

Michael Novogratz: bitcoin and gold could continue to rise because of ‘global liquidity pump’

CEO for Galaxy Digital said that bitcoin could reach $20,000 by the end of the year. (20% of his net worth is in bitcoin).

He predicted that gold could rise too as long as the central banks continue to print money.

Your Money

Insights, trends and what this means for you and your purse

Under the plan, over-40s would have to pay more in tax or national insurance, or be compelled to insure themselves against the cost of care.

Managing financial uncertainty: how to open up and talk about money

Choose who to open up to

Create a comfortable setting

Prepare how you’re going to kick it off

Listen as well as talk

Check in with others around you

Companies: winners & losers

Companies to watch and share price movements

Shares in Kodak surged 2,441% higher this week, sending its market cap close to $2bn

Kodak, the camera making firm, has ‘won’ a government loan (valued at $765m) to help produce ingredients in key generic medicines to fight Covid-19.

Kodak’s business was devastated after it failed to adjust to digital photography. The company does not have expertise or experience in the pharmaceutical industry.

Read about how insider trading and crony capitalism might be at the centre of this deal, and funded by the US taxpayer’s money.

Big tech is eating the world: the total market cap of Facebook, Amazon, Netflix, Google, Microsoft, Apple and Nvidia is now at $7.2tn, which is equal to the GDP of Japan and the UK.

On Friday, Facebook, Apple and Amazon reported quarterly earnings which beat analysts expectations.

Alphabet’s earnings exceeded expectations but reported its first revenue decline in the company’s history.

Lloyds Bank reports loss after setting aside £2.4bn

Britain’s biggest high street lender reported a loss of £676m for the three months to June, down from a £1.3bn profit during the same period last year.

Lloyds, which is seen a bellwether for the UK economy as it is one of the most domestically focused banks, said it expects impairments to total £4.5bn to £5.5bn by the end of the year.

In the Spotlight

Is there a topic you'd like us to Spotlight? Please tweet @jointhepurse

Big tech: what does this mean for investors?

Apple, Microsoft, Amazon, Alphabet and Facebook now represent more than a fifth of the S&P 500.

Big tech continues to grow its influence in the markets:

For the first time in 42 years, the top five have accounted for 20% market cap in the S&P 500, and (for the first time) they are all technology companies.

The greater sway in the market represents a significant risk for investors: when the shares in the top five decline, it will squash the gains of the broader market.

There is a concentration of risk for investors holding an index fund.

Tesla is the next contender to join the S&P 500: valued at $277bn, but it is not yet clear when they will be added to the index.

It looks like big tech will only get bigger unless new regulation is introduced.

Have You Seen This?

Female-focused news, reports, research, campaigns

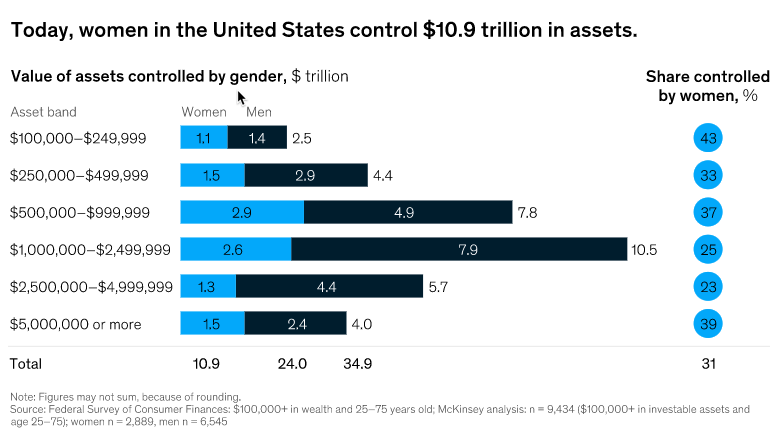

US: Women’s wealth will triple in the next decade

Women currently hold $10tn in wealth.

Men currently control 70% of total assets.

According to a survey by McKinsey & Co:

In the next 3-5 years, approximately $30tn will shift into the hands of women. This is largely driven by baby boomers inheriting wealth after their spouse dies and younger financially savvy women.

Know this: women are taking centre stage when it comes to money and wealth. The wealth management industry has been tracking this data for many years but has been slow to change. In the US, women represent just 15% of financial advisers. There has never been a better time to study and engage with your money so that you can choose the right advisers, at the right time. Stay in control of your wealth, grow your net worth and build your financial future.

UK economy is missing out on £47bn due to a lack of women in leadership

Women Count 2020, report reveals that:

FTSE 350 companies with more 33% of women on executive committees have a net profit margin more than 10 times greater than those companies with no women at this level.

There is an abysmal number of women in leadership positions. In 2020, there are just 13 female CEOs of FTSE 350 companies. That is a mere 5% of company leaders.

There may still be a lack of desire for positive change in many businesses and the prospects for women seeking to make it to CEO.

The pace of progress is too slow.

Know this: company culture is often very slow to change. We know the more senior women there are in a business, the more senior women are hired and retained. Look for companies with women in senior and executive roles, ideally above 33% (this is the point at which we start to see the impact of women’s insight, decision-making and management).

European retailers: male bosses still decide

Bloomberg survey of 12 retailers found:

on average, 63% of women make up the retail workforce

Less than 25% of these companies have women in leadership

In Britain, not a single retailer in the FTSE 350 is run by a woman.

Know this: women make 85% of all consumer purchasing decisions. And in the UK, large firms whose executive boards are one-third female are 10 times more profitable on average than all-male boards. There is a huge incentive for firms to attract and retain women who want to move up the ranks.

US study: the hidden ways women way companies are paying unfairly

In July, women earned 84 cents for every dollar a man earned.

Women miss out on equity-based rewards especially in the tech industry:

these are stock grants or equity (where you own a percentage of the company) or

stock option grants or employee stock options (which grants employees to buy shares in the company at the present price in the future).

Based on a study, a gender gap emerged favouring men when it came to distributing stock options based on retention–but not based on potential.

Know this: men are perceived as more valuable in the workplace, which explains why companies will give men more equity or employee stock options (in order to retain them). Bear this in mind and remember to negotiate at least another 30% on your equity or employee stock option offer.

What We’re Tracking

Female-focused products or services, start-ups and businesses led by women, investment and research.

LOOM: (US)-founded in 2016 by Erica Chidi and Quinn Lundberg, is building an entirely new approach to online learning to help you thrive in your body at every stage. LOOM’s mission is to offer empowered education on everything from periods and sex to pregnancy and menopause, aimed at women and non-binary people.

The company has just raised a seed round of $3m to go beyond its brick-and-mortar centre to offer a new digital product and platform.

Erica is one of the few black women who has raised over $1m.

Martha Brook: (UK)-founded by Martha Keith in 2013, is a personalised productivity startup, based in London. The company has shipped more than 200,000 pieces of stationary globally. In 2019, Martha Brook turned over £1m.

Check out their crowdfunding campaign here. Key facts:

Profitable every year since launch. In 2019 direct sales grew at 56%

Widely featured in press including Daily Mail, Forbes, The Independent

More than 40,000 followers across social media networks

Customers across more than 50 countries including the US and Australia

MacKenzie Scott pledges to give $1.7bn to causes supporting women, LGBT rights and racial equality

Jeff Bezo’s ex-wife and writer, is estimated to have a net worth of $36bn and is the forth richest woman in the world, according to Forbes.

One year ago she pledged to give all her wealth away ‘until the safe is empty’.

Money Habits of the Week

Do you have a money habit you would like to share with us? Tweet @jointhepurse

We all need an emergency fund or a financial cushion for those unplanned expenses or when life throws you a curveball.

It’s good to check in regularly on how much you are saving into this account.

If you have had to dip into your fund recently, make a plan for when you can start topping it up again.

You may be in the fortunate position to be saving a lot more during the pandemic, do make sure that you also put more money away and pay off any credit card debt.

And, don’t forget to look into ways you can invest your money.

(Remember, interest rates are very low at the moment and you will be earning a low return on your hard earned money if it is sitting in a savings account or a cash ISA).

What We’re Watching

Yanis Varoufakis is an economist and a former Minister of Finance for Greece and he is rethinking the economy, finance and capitalism.

Watch this TED talk: Yanis believes that the mega-rich and corporations are cannibalising the political sphere, causing financial crisis. He maps out his dream for a world in which capital and labour no longer struggle against each other, ‘one that is simultaneously libertarian, Marxist and Keynesian’.

Coffee Break? Read This

We’d love to hear from you. Get in touch with Jana via the The Purse website or tweet @jointhepurse and @janicka.

The Purse Ltd. Copyright 2020 & All Rights Reserved.

Share this post