China's economy shrunk for the first time on record, global output loss projected to be $9 trillion, why the disparity between rallying stock markets and the declining economy and more

Weekly newsletter for women who want to be smart about money: financial news, personal finance and investing

Welcome to our #16 weekly newsletter in 2020.

Every week we curate key articles and content so you can stay informed and inspired about money and investing without the boring bits!

This is your weekly go-to place to read up on all things money-related.

We spend hours sifting through content every week and apply a female-lens to news and content about money and investing so that it is meaningful to you.

Ultimately we want to support you in making well-informed financial decisions, grow your net worth and ensure your financial security.

Photo: Fauxels

From The Purse…

Editorial from the Founder

We are seeing a growing disparity between the sentiment of investors and the global economy.

Since 23 March stock markets have rallied in response to the central banks and governments swift monetary and fiscal interventions. Interest rates have been cut and vast stimulus packages have been introduced.

However as people stay home the global economy continues to decline.

In the US unemployment has risen to 22 million and the International Monetary Fund (IMF) is forecasting a global output loss of $9 trillion in 2020 and 2021.

Goldman Sachs’ top equity analyst expects that the financial markets to plunge again as stocks have risen ‘too far too fast’.

And if companies start to default on their loans, this will cause havoc in the credit markets.

It was reported Thursday that trials testing a Covid-19 drug by Gilead Sciences are going well and the European stock markets extended their rally on Friday.

As always, there are lots of moving parts to observe and be mindful of as an investor.

I hope you enjoy this week’s newsletter. And until next week!

Jana

The Big Picture

Global markets and economy news, trends and indicators

The Coronavirus Effect:

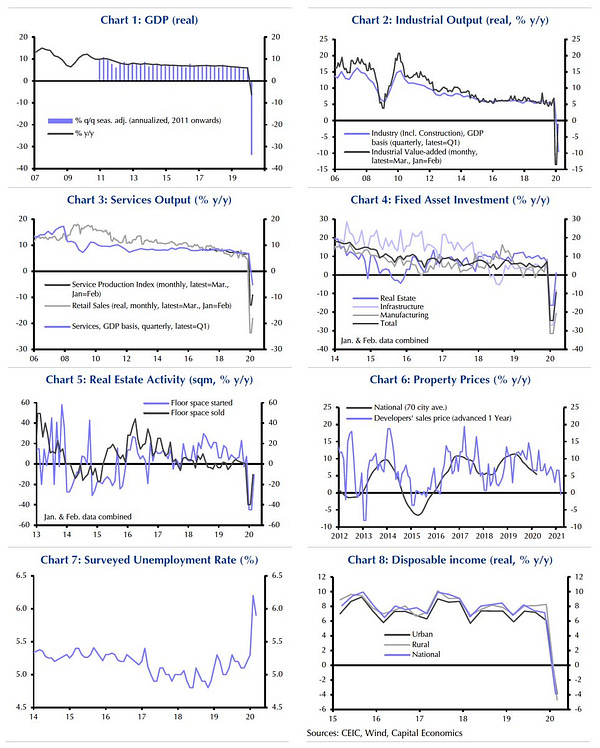

China’s economy shrunk for the first time on record from the coronavirus outbreak.

Chinese GDP contracted by -6.8% in the first quarter of 2020.

This is worse than economists projected at -6.5%.

There are concerns that data is not telling the whole story and many economists question the reliability of China’s data.

The Chinese economy will do well to grow at all in 2020.

There is also growing concern over a second wave of coronavirus in China.

Weekly jobless claims totalled 5.245 million

Total unemployment has jumped to 22 million, nearly wiping out all the job gains since the Great Recession in 2009.

The BoE Governor Andrew Bailey said “banks had to address the ‘serious strain’ on their ability to process a surge in demand for credit and ‘sticking to risk assessment processes that were too slow’.

A 35% fall in Britain's economic output in the second quarter of 2020 was ‘not implausible’.

UK job furlough scheme extended to end of June

The Treasury has announced to extend the UK’s job’s furlough scheme to reflect ‘the continuing social distancing measures’.

European stocks extend rally on optimism over Gilead Sciences trials to find a Covid-19 drug.

Most stock markets have rallied since March 23

S&P 500 has recovered to -17.2% vs -33.8%

Europe’s main benchmark has rallied 15.9%

FTSE 100 has recovered to -26% vs -34.9%

Equity markets have recovered to some extent but not to pre-crisis levels.

Looking Ahead in 2020

The International Monetary Fund (IMF) has projected global GDP to decline -3% in 2020.

This is a downgrade of 6.3 percentage points from January 2020, a major revision over a very short period.

This makes the Great Lockdown the worst recession since the Great Depression, and far worse than the Global Financial Crisis.

The cumulative output loss for 2020 and 2021 is projected to be $9 trillion.

On Thursday Peter Oppenheimer, Goldman's number one stock strategist, said gains in the stock markets have been premature and that stocks will drop again before a true recovery.

Global slowing of coronavirus infection rates and growing fiscal interventions from governments have reduced some risk for investors and helps explain the market rally.

A correction may be imminent and a significant price crush would be on the horizon.

He expects a strong recovery in the economies in the second half of 2020.

Economic recovery is less likely to be a ‘V-shape’ and more challenging than investors would expect.

According to Ray Dalio the economic recovery will require ‘lessening of wealth gap’ (US)

Before the coronavirus, Ray Dalio warned that the wealth gap represented a ‘national emergency’.

He said: “We will have a lot of people suffering financially, not just here, but around the world. I worry about the anger and the fighting and what that might be like….In either case, we still have the greatest asset of humanity — the ability to adapt, invent and come up with things.”

Coronavirus Impact: Your Money

Insights, trends and what this means for you and your money

Savers to check the interest rate on their savings account now (UK)

If earning less than 1.3% switch now.

Companies to Watch: winners & losers

Companies to watch and share price movements

Gilead Sciences share price on Friday soared 12% on reports of a promising drug for Covid-19.

Reported Thursday on STATNews-it described some patients in a Chicago clinical trial of Gilead’s drug remdesivir in treating COVID-19 as responding well and with rapid improvements.

Gilead has had its biggest gain since 2012.

Foxtons, the London’s focused estate agent plans to raise £22m through a share placement to shore up its balance sheet as running out of cash.

Revenue could fall as much as 78% if lockdown continues until end August.

From a pre-outbreak peak of 95p in mid-February, Foxtons had since fallen 60%. Shares in the company rose 12% on the announcement.

Foxtons has sought to cut is outgoings by closing all branches and furloughing 70% of staff.

In the Spotlight

Is there a topic you'd like us to Spotlight? Please email jana@jointhepurse.com or tweet @jointhepurse

Why are the global stock markets rallying as people lose their jobs and economies slump?

Central banks, led by the US Federal Reserve, have intervened using monetary and fiscal measures in order to limit the coronavirus induced economic downturn.

Crucially, they are propping up a global financial system which is awash with debt.

Such actions suggest the worst is behind us which is why stocks have rallied.

Meanwhile the global economy is deteriorating.

Unemployment is on the rise and global output loss is projected to $9 trillion in 2020 and 2021. Economic damage is unlikely to be at its peak yet.

Investors will need to assess the whether the banks and governments can do enough.

Ultimately policymakers are unlikely to limit a wave of defaults and rating downgrades which will cause havoc in credit markets.

So the global markets may turn if credit defaults start to rise.

Have You Seen This?

Female-focused news, reports, research, campaigns

Coronavirus layoffs could erase many of women’s workplace gains.

How coronavirus has impacted leading female founded startups (US)

Covid-19 has been harder on women business owners. These 11 resources could help (US)

What We’re Tracking

Female-focused products or services, crowdfunding campaigns, start-ups and businesses led by female entrepreneurs & investment, research

InHerSight: (US)-uses data to help women find and improve companies where they can achieve their goals. Co-founded by Ursula Mead, the start-up has raised $5 million from investors including Motley Fool Ventures, GrowthX and Carolina Angel Network.

The InHerSight platform, first launched in 2015 and has recently launched a mobile app which personalises a job search to career goals.

Women anonymously rate their workplaces, which allows the company to collect data on 16 key metrics that often matter more to working women.

Money Habits of the Week

Do you have a money habit you would like to share with us? Tweet @jointhepurse

This is a good time to focus on repaying your debt as much as possible.

Identify debt with the highest interest rate and prioritise paying this debt down first.

By reducing your debt, you will also minimise your outgoings.

Savings you make on paying off your debt or paying less debt will allow you to save more and/or invest your money for growth.

Caught Our Eye

Digital tools for managing your money and investing

Nutmeg: (UK) -is an investment platform. They build and manage diversified portfolios, using technology to keep charges low and show where you’re invested.

Open a pension, a lifetime ISA, a Junior ISA, a stocks & shares ISA and a General Investment account.

Set your goal, choose your investment style (eg fully managed, socially responsible) and leave the rest to Nutmeg.

(Disclaimer: this is for information only).

What We’re Watching

Chrystia Freeland, Deputy Prime Minister for Canada and writer, talks about the rise of the new global super-rich in this TED talk in 2013.

And why we need social and political change.

Coffee Break? Read This

We’d love to hear from you. Do you have feedback? Have we missed anything? What would you like to see more of? Get in touch with Jana via the The Purse website or tweet @jointhepurse and @janicka.

The Purse Ltd. Copyright 2020 & All Rights Reserved.