Welcome to our #50 weekly newsletter in 2020.

Every week we curate key content and apply a female-lens so you can stay informed and inspired about money and investing.

Stay in the know.

Keep on top of global economic, financial and investing news and trends. And read about what this means for you and your money in 2020 during Covid-19 and beyond.

If you’re short on time, listen to the audio for a brief overview.

“For women who are taking control of their financial future”

-Jana Hlistova

From The Purse

Editorial from the Founder

The global stock market continues to go up in value; global stocks are now equal to 116% of global GDP (the highest level since 2007).

The US Federal Reserve has agreed to keep on buying bonds until the economy gets back to full employment (and inflation stays at 2%).

The Bank of England (BOE) has agreed to leave rates at 0.1% and holds asset purchases unchanged at £895bn.

US and European inflation expectations have risen above pre-Covid levels, even though UK inflation fell to 0.3% in November.

Meanwhile Brexit talks remain blocked over fishing rights.

Bitcoin has become investible for institutions with custodian arrangements and the price rose above $24,000 this week.

In the Future Focus section, MSCI says that diversity and inequality metrics will see ‘a lot of scrutiny’ next year as ESG investing grows.

Tesla shares surge to a new high on S&P 500 inclusion (on the 21 December).

In the Have You Seen This section, we highlight ex-COO of Pinterest, Francoise Brougher, who has reached a $22.5m settlement in a gender discrimination case.

And we’re tracking a European early-stage venture capital fund, co-founded by Pia d’Iribarne, which has raised $56m and has already started making investments.

****

I’d like to wish you a safe Christmas and all the very best for 2021!

Thank you being on this journey with us.

And we will be back on the 10th January.

Stay safe, look after yourselves and your loved ones.

Jana

The Big Picture

Global markets and economy news, trends and indicators

The global stock market continues to go up in value: global stocks are now equal to 116% of global GDP, the highest level since 2007:

The Federal Reserve commit to keep buying bonds until the economy gets back to full employment & inflation stays at 2%

Short-term borrowing rates to be held at zero.

At least $120 billion a month in purchases will continue and the duration of bonds will not be extended.

The balance sheet has already jumped to record at 36.5% of the UK's GDP.

The BoE will leave the stimulus policy unchanged.

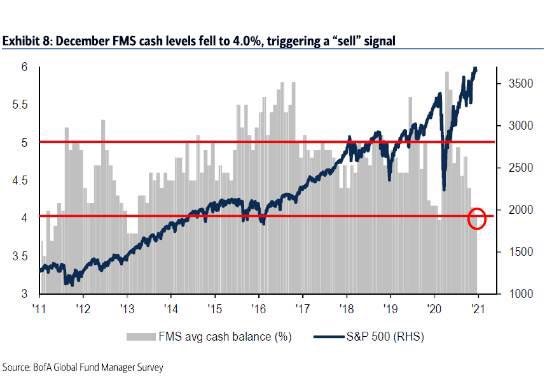

US: cash levels are low

Money managers overseeing $534bn are underweight in cash for the first time since May 2013.

Investors are bullish most on stocks and commodities since February 2011.

US and European inflation expectations have risen above pre-Covid levels

However, in the UK, inflation fell to 0.3% in November from in 0.7% (in October) due to discounting by clothes retailers.

Brexit talks remain blocked over fishing rights

British officials say EU side still not showing enough flexibility to get deal over the line.

Bitcoin has become investible for institutions with custodian arrangements available; bitcoin price has risen above $24,000 this week

The fund has invested $600m+ in bitcoin.

Future Focus

Keeping an eye on key predictions, innovations and what’s going to impact the future

Biggest inflows in 2020: gold, technology stocks and cash

US: Guggenheim Chief Investment Officer says that bitcoin should be $400,000

Scott Minerd has said that the price target is based on two things:

the asset's scarcity and

its relative value to gold as a percentage of gross domestic product.

The Nasdaq’s recent proposal to require more diversity on boards of companies listed on the exchange is just one example of a sustained push that is likely to strengthen.

Inequality more broadly will also be a major focus following the economic hardship wrought by the Covid-19 pandemic.

Companies: winners & losers

Companies to watch and share price movements

Tesla shares surge to a new high on S&P 500 inclusion

The carmaker becomes the 6th largest company in the index.

There are more than 200m shares in Tesla, worth more than $148bn.

Your Money

Insights, trends and what this means for you and your purse

UK: Pension freedoms have cost too many people their life’s savings

The City watchdog’s recent case against a firm of financial advisers highlights a series of problems.

Pension freedoms rules brought in during 2015 has meant that people can move their occupational pensions into self-invested personal pensions (SIPPs) and invest in pretty much anything they like.

In the current low interest rate environment, it is easy to be tempted into eye-catching alternatives where they may earn 20% returns (however they also risk losing their investment altogether).

Have You Seen This?

Female-focused news, reports, research, campaigns

Pinterest, former COO reaches $22.5m settlement in gender discrimination case

The settlement comes after former chief operating officer Francoise Brougher sued the company in August for allegedly excluding her from important decisions after refusing to ‘take a back seat to her male peers.’

Francoise who worked as COO for two years, said she was terminated for objecting to demeaning and sexist treatment.

Know this: as women take on more leadership positions and therefore have more clout, they will bump up against informal or tacit gender and cultural ‘codes’. Research shows that women continue to be held to a different standard and are treated differently in the workplace, compared to men. It’s important to seek out employers and colleagues who are forward-thinking and can demonstrate an inclusive, diverse and transparent company culture and leadership.

What We’re Tracking

Female-focused products or services, start-ups and businesses led by women, investment, crowdfunding campaigns and research.

New Wave (Europe)-co-founded by Pia d’Iribarne, is a a early-stage venture capital fund:

Its debut fund of $56 million was raised in just three months and has already begun making investments.

It is said to be targeting seed and pre-seed startups across Europe.

Cheque sizes will be between €500,000 and €2 million, with New Wave both leading and co-investing in rounds.

High-profile LPs include Yuri Milner of DST, Peter Fenton from Benchmark, Philippe Laffont from Coatue and Tony Fadell of Nest and Apple fame.

Coffee Break? Read This

Female leaders make a real difference. And Covid may be proof.

Equalities minister Liz Truss runs department with second-biggest gender pay gap

We’d love to hear from you. Get in touch with Jana via the The Purse website or tweet @jointhepurse and @janicka.

The Purse Ltd. Copyright 2020 & All Rights Reserved.

Share this post