Weekly newsletter for women who want to be smart about money: financial news, personal finance and investing

Welcome to our #29 weekly newsletter in 2020.

Every week we curate key content and apply a female-lens so you can stay informed and inspired about money and investing.

Stay in the know.

Keep on top of global economic, financial and investing news and trends. And read about what this means for you and your money in 2020 during Covid-19 and beyond.

If you’re short on time, listen to the editorial on audio for a brief overview.

“Our mission is to help women take control of their financial future”

-Jana Hlistova

Photo: Christina @ wocintechchat.com

From The Purse…

Editorial from the Founder

The World Health Organisation (WHO) has said that the pandemic is getting worse. Coronavirus infections are rising in 40 US states and in other cities and countries around the world.

Although a V-shaped economic recovery is less likely, investors are feeling optimistic about a Covid-19 vaccine.

Moderna’s share price soared 18% after an early coronavirus vaccine trial produced antibodies in all patients.

Read about why Ray Dalio thinks that the US-China tension will escalate into a ‘shooting war’ and we spotlight why investors are worried about ‘Japanisation’.

We highlight a report about financial management in households and why women tend to do twice as much budgeting than men.

We’re tracking a femcare startup called Callaly which provides organic cotton period products by home delivery. Dr Alex Hooi, who founded the company, also invented the tampliner. The startup is crowdfunding at the moment so check out their pitch video.

We’ve also become a bit obsessed with Page & Bloom-a social enterprise set up to provide opportunities for women who have experienced domestic abuse. Ever thought about buying paper flowers and helping women at the same time? Well now you can.

And check out my podcast interview with Julia Elliott Brown, Founder & CEO of Enter the Arena, the UK's leading fundraising and growth advisor for women entrepreneurs. We talk about female founders, raising capital, why crowdfunding makes sense and how women can invest.

Stay safe, look after yourselves and your loved ones.

I hope you enjoy this week’s newsletter. Until next week,

Jana

The Big Picture

Global markets and economy news, trends and indicators

The Coronavirus Effect:

WHO: COVID-19 pandemic could get 'worse and worse and worse'

The number of coronavirus cases is at 13m globally.

The pandemic has now killed more than 500,000 people in 6.5 months.

The US has more than 3.3m coronavirus cases confirmed.

Coronavirus infections are rising in about 40 U.S. states.

The EU is in deadlock over €750bn recovery fund

The criteria for deciding how to allocate money is still to be agreed.

UK: a V-shaped recovery is unlikely

The economy contracted by 20.3% in April and rebound by 1.8% in May.

Reuters economists had expected a 5.5% increase in May.

Although the Bank of England has said that the UK economy is beginning to recover, it is unclear how much long term damage there will be.

UK inflation rose to 0.6% in June

Higher prices of games and clothes meant that inflation rose from 0.5% in May to 0.6% in June.

UK unemployment continues to rise

According to official figures, 650,000 jobs have been lost since March.

The unemployment rate was 3.9% in May but will rise after the furlough ends in October.

Unemployment could reach 15%-20%.

US retail sales increased a better-than-expected 7.5% in June

In May, retail sales also jumped by 18.2%.

Reuters economists had expected a 5% increase in sales in June.

Rising coronavirus cases threatens the economic recovery.

Investors are optimistic over Covid-19 breakthrough

“A study on Remdesivir showed that the drug reduced coronavirus fatalities by 62%. Boosting sentiment further Pfizer and BioNTech announced that their vaccine could be approved by the FDA as soon as December”

Investors believe a vaccine is how the economy will be able to bounce back and stabilise.

Future Focus

Keeping an eye on key predictions, innovations and what’s going to impact the future

US: why stock market will continue to go up and why it is not disconnected from the economy

Investment Strategist Brent Schutte believes that:

the worst economic effects are behind us

treatment capabilities have improved and progress towards a vaccine is underway

and the Federal Reserve’s support of the markets will continue.

Schutte said that the monetary and fiscal policymakers have done their job, the economy is reopening, a vaccine will be found soon and there was ‘nothing wrong with the US economic fundamentals’.

Super-rich call for higher taxes on wealthy to pay for Covid-19 recovery

The group is made up of 83 members including Disney heir, Abigail Disney Ben and Jerry’s ice cream co-founder Jerry Greenfield.

US-China tensions could escalate into a ‘shooting war’

In a Linkedin post, Ray Dalio has said that the US and China are now in an ‘economic war’ which could escalate.

He wrote: ‘Severe economic downturns with large wealth gaps, large debts, and ineffective monetary policies make a combustible combination that typically leads to significant conflicts and revolutionary changes within countries…’

Your Money

Insights, trends and what this means for you and your purse

UK: how the coronavirus is impacting jobs and money:

9m+ have been furloughed and have taken a 20% pay cut.

2.7m self-employed have applied for income support

Unemployment March-May was at 12.5% (but this is likely to increase)

Universal credit applications are at a record high since March

Households have paid off loans and credit cards.

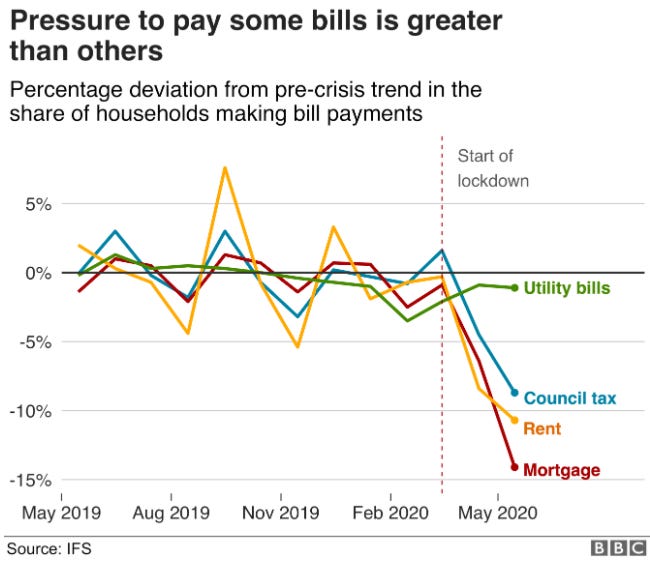

Less people are able to make their mortgage and rent payments.

UK house prices soar 300% in the last 20 years

However the average income has only risen by 70%.

In 1999, the average price for a house in the UK was just £77,961 vs £230,735 today.

A standard deposit is now approximately 76% of average income vs 43.5% of average income in 1999.

The house market prices fell during the pandemic and it is expected they will fall by another 5% over the next few months and as unemployment rises.

Family fortunes of the wealthy increase and the poorest are hit hardest by the coronavirus

Based on a report, UBS found that 77% of the richest families had seen their investment portfolios ‘perform in line with, or above, targets during one of the most volatile moments in the history of financial markets’.

The poorest households have seen a decline in average monthly earnings by 15% ie by £160 per month.

Companies to Watch: winners & losers

Companies to watch and share price movements

Goldman Sachs second-quarter earnings exceed expectations

Goldman generated $2.42 billion in profit, or $6.26 a share, crushing the $3.78 a share estimate of analysts surveyed by Refinitiv.

Revenue of $13.3 billion was more than $3.5 billion higher than expected.

Bond trading revenue surged almost 150% to $4.24 billion, and equities trading revenue rose 46% to $2.94 billion.

‘The Fed has been able to engineer a huge bounce-back in the markets by injecting trillions of dollars, benefiting investment banks primarily’.

Moderna soars 18% after early coronavirus vaccine trial produces antibodies in all patients

‘The company plans to start a 30,000-participant Phase 3 study on July 27 to demonstrate our vaccine's ability to significantly reduce the risk of COVID-19 disease’ CEO Stephane Bancel said.

Moderna’s share price is up 344%+ this year.

Netflix shares drop despite despite positive second quarter earnings

The company added 10.1m subscribers (vs the expected 8.07m) due to coronavirus lockdown, bringing revenue to $6.15bn (vs the expected $6.05bn).

However Netflix predicts a dip in paid subscriber numbers in the third quarter as lockdown eases and furlough schemes come to an end.

Shares fell by 10%.

In the Spotlight

Is there a topic you'd like us to Spotlight? Please tweet @jointhepurse

Why are investors afraid of ‘Japanisation’?

‘Japanisation’ refers to a lost decade or two experienced by Japan as its economy stagnated.

This is as a result of excessive global debt, an ageing population, the impact of technology (structural changes) or a lack of more broad investment from central banks and the government.

The convergence of global economic and market indicators show that Europe (and everyone else) is heading towards it or is already there.

Inflation in advanced economies and global government bond yields have converged with Japan ie they have declined.

More reforms and monetary support is needed. And greater investment (is needed) in infrastructure and the middle class.

Have You Seen This?

Female-focused news, reports, research, campaigns

A new report by Starling Bank in partnership with the Fawcett Society, explores the dynamics of financial management in households with women who are living with male partners.

The key findings include:

Women are twice as likely to manage the household budgeting.

Men are more likely to shop for tools for the house and household insurance.

More women than men would not be financially independent if they split up with their partner (46% women vs 56% men).

71% of women said they scored themselves 7 or higher in being confident they can manage their money vs 67% of men who scored the same.

Know this: women spend more time budgeting than men but tend to defer long-term investing decisions to their partner, regardless of their age. It’s a good idea to talk to your partner about sharing the ‘budgeting admin’. This should free up time for women to become more engaged as investors.

What We’re Tracking

Female-focused products or services, start-ups and businesses led by women, investment and research.

Callaly: (UK)-founded by Dr Alex Hooi, who invented the tampliner.

The tampliner combines an organic cotton tampon with a soft mini-liner for built-in leak protection, with unique clean insertion and removal (no hard plastic applicator).

As well as inventing the tampliner, Callaly offers a range of organic cotton period products in customisable mixes, by home delivery and on subscription.

Check out their crowdfunding campaign here.

Key facts include:

£26bn global femcare market – their potential tampliner market is estimated at 2%-4% by 2024

Fast subscriber growth >160% between March and May 2020

4 patents cover 80% of the market; Deloitte valued it at £90m

£7.9m angel & Innovate UK funding to date; bespoke machinery developed.

Page & Bloom: (UK)- is a social enterprise created to provide fair employment and opportunities for women who have experienced domestic abuse. Ever thought about buying paper flowers and helping women at the same time? Well now you can.

Page & Bloom is reinventing floristry with paper flowers, transformed from preloved books, maps and paper.

Each of their paper flowers is individually hand made, transforming paper into stunning floral designs. We’re kinda obsessed.

Bumble: (US)-is a (social and) dating site that allows women to swipe first; founded by Whitney Wolfe Herd in 2014 as an alternative to Tinder. (We like their mission-first ethos: Bumble has pledged that at least 15% of the company’s marketing spend goes to Black-owned businesses).

A bit of back story: Whitney co-founded Tinder, the popular dating app, and became the VP of marketing.

She is credited for coming up with the name and growing the user base on college campuses. Whitney left in 2014 and filed a sexual harassment and discrimination lawsuit. She reportedly received $1m in settlement, moved to Austin, Texas and partnered with Andrey Andreev, founder of Badoo who approached her about creating a new dating platform. The rest is herstory as they say…

The company already has over 100m users, however it will bring its sibling dating app Badoo under the same brand (Bumble).Together Bumble and Badoo will have 600m active users.

The company announced Wednesday that it will be bringing on a new president, Tariq Shaukat, previously president of industry products and solutions at Google Cloud.

Money Habits of the Week

Do you have a money habit you would like to share with us? Tweet @jointhepurse

Don’t ignore money or making financial decisions which will have a lasting impact on your long-term security.

Strength and security is what is at the heart of women and money.

We know that most of the time women engage when there is a crisis or a life-altering event.

Small changes we can make every day, add up to big changes over time.

Pay attention, learn, study and engage with your money and investing.

And make it fun.

Check out some crowdfunding campaigns: watch their pitch video, review their pitch deck and documents. If you have time, sign up for one of the virtual events where you can ask questions and talk to the founder.

What We’re Watching

Curtis ‘Wall Street’ Carroll overcame poverty, illiteracy, prison and a lack of outside support to become a stock investor, creator and teacher of his own financial literacy philosophy.

Watch the TED talk where Curtis talks about financial literacy not being a skill but a lifestyle and why we all need to be more savvy with money.

Coffee Break? Read This

We’d love to hear from you. Get in touch with Jana via the The Purse website or tweet @jointhepurse and @janicka.

The Purse Ltd. Copyright 2020 & All Rights Reserved.

Share this post