Loss of nature will wipe £368bn a year off global economic growth by 2050, Africa could emulate China's rapid rise, what is an index fund, and we celebrate Anne Boden, CEO of Starling Bank

Weekly newsletter for women who want to be smart about money: financial news, personal finance and investing

Welcome to our #7 weekly newsletter in 2020.

Every week we curate key articles and content so you can stay informed and inspired about money and investing without the boring bits!

This is your weekly go-to place to read up on all things money-related.

We spend hours sifting through content every week and apply a female-lens to news and content about money and investing so that it is meaningful to you.

Ultimately we want to support you in making well-informed financial decisions, grow your net worth and ensure your financial security.

Photo by Elle Hughes

From The Purse…

Editorial from the Founder

Women on average tend to spend an extra hour a day on household chores, compared to men.

This is time that women could allocate to reaching out to a financial adviser, researching online investment platforms or learning more about impact investing.

Given the fact that as women we are exposed to greater financial risk over our lifetime, it is paramount that we carve out the time we need to manage our money and plan our investments.

We know that working practices need to change to allow for men to ‘step up to the plate’ and share in childcare, but as women we are must be proactive in claiming back time at home.

So why not have an open conversation with your partner or loved ones about why this is important and how they can support you?

Perhaps it is sitting down at least once a week for an hour to consider how to go about finding a financial advisor. Or perhaps it’s deciding to allocate 30mins every morning to read about investing via online investment platforms. Or it can mean signing up to a community of women who want to learn and connect about money and investing.

We owe it to ourselves to have the clarity and peace of mind we need for today and for the future.

I hope you enjoy this week’s newsletter. Until next week!

Jana

The Big Picture

Global markets and economy news, trends and indicators

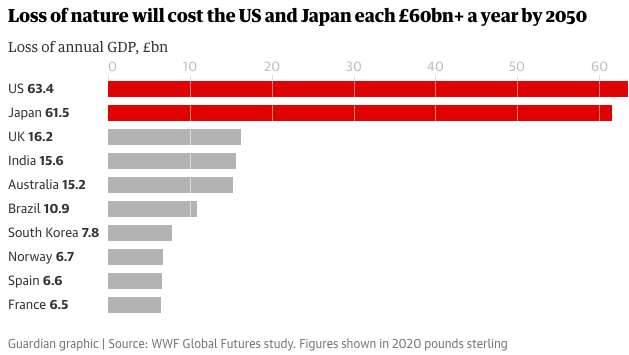

Global economic growth will take big hit due to loss of nature, according to a study by the World Wildlife Fund (WWF):

Loss of nature will wipe £368bn a year off global economic growth by 2050.

The UK will be the third-worst hit, with a £16bn annual loss.

Over the next 30 years the cost could total £8tn.

According to The Stern Review (2006), ignoring climate change could cost up to 20% of GDP.

UK economy stalls: zero growth in the final three months of 2019. According to the Office of National Statistics (ONS) this is due to a slump in consumer spending and decline in manufacturing output.

The Chancellor of Exchequer, Sajid Javid resigned Thursday (13 February) and is expected to mean ‘looser fiscal policy’ and will be good news for UK assets.

"We already thought that the Budget on 11 March would involve an extra loosening in fiscal policy worth 0.5% of GDP, which coming on top of the extra government spending announced in September 2019 would mean a fiscal boost of 1.0% is in the pipeline.”

US boasts most millionaires worldwide, according to Wealth-X.

After the US market, which makes up 40% of global wealth market share, China and Japan’s wealth markets are ranked second and third respectively.

According to Wealth-X data, 32.1 percent of women's net worths were either wholly or partially inherited, while the same is said for 12.4 percent of their male counterparts.

The cryptocurrency market is hovering close to a $300bn market capitalisation. Track the crypto market here.

Looking Ahead in 2020

Seven macro themes in 2020: (US focus & global)

Time for recession has increased

But ‘loss given recession’, has increased too

Potential cracks in the corporate credit cycle

The housing market

The world leads, the US lags

Inflation

Dealing with disruption

Africa could emulate China’s rapid rise:

If Africa sustains and accelerates structural reforms, some believe the continent can emulate China’s rapid rise of the last 50 years.

McKinsey predicts $5.6 trillion in African business opportunities by 2025.

‘The system is broken’: the billionaire investor who fears a return to the 1930s

Ray Dalio, who has a near $19bn fortune, is one of a handful of the 0.01% to go public with concerns about the system that created that wealth.

“The gap between rich and poor has grown too wide, and most people have not seen real income growth in decades. The economy is stacked against those at the bottom.”

Dalio has published a new book Principles for Success, a slimmed down illustrated version of his 600 page book: Principles: Life and Work.

In the Spotlight

Is there a topic you'd like us to Spotlight? Please email jana@jointhepurse.com or tweet @jointhepurse

What is an Index Fund?

In 1975, John Bogel, the founder of Vanguard, pioneered a new way of investing, the index fund.

Index funds track the overall performance of an entire market index like the FTSE 100, S&P 500 or the Nasdaq.

So rather than rely on analysts or fund managers to select individual shares or bonds (often referred to as active investing) an index fund will buy shares and bonds in a company the index is tracking* (often referred to as passive investing). *Or a representative sample of those shares and bonds.

Based on recent data, passive investing is on the rise.

Have You Seen This?

Female-focused news, reports, research, campaigns

A third of people ‘likely to take on more debt if faced with an income shock’

Women and younger adults aged 18 to 34 would be particularly likely to turn to loved ones for financial help rather than a formal lender, the research found.

There are more funds run by Daves than by women

Of 1,496 UK-listed open-ended funds, 108 are run by managers named David or Dave – equivalent to 7.2% of funds, according to Morningstar. Meanwhile, just 105 funds in total have a woman at the helm.

“It is disappointing to see so few women fund managers in our industry,” says Emma Morgan, London-based portfolio manager at Morningstar. Morgan believes that diversity optimises decision-making in groups. Therefore, she says, “encouraging more women into portfolio management can only lead to better outcomes for investors”.

…CII had pointed out to the FCA that, in some of its handbooks and its constitutional documents, the FCA itself was using language that was not gender neutral.

The data it collects on the industry is still largely aggregated. For example, it cannot break it down meaningfully into gender splits, which could be problematic when it comes to creating or amending legislation.

The majority of VC firms still have no female investors (US)

According to a new report by All Raise, 65% of VC firms still have zero female partners or GPs.

What We’re Tracking

Female-focused products or services, crowdfunding campaigns, start-ups led by female entrepreneurs & investment, research.

Starling Bank: (UK)-founded in 2014 by banking veteran Anne Boden, one of the top challenger banks was voted Best British Bank in 2019.

On Monday the ‘start-up’ announced they had raised £75m to fund its expansion.

The expansion will build on Starling’s rapid success to date in the UK and underscores its ambitions to change the face of banking: since launching its app in May 2017, Starling has built up a customer base of 460,000 personal current accounts and 30,000 SME accounts. The bank expects to hit one million customers by the end of 2019.

Money Habits of the Week

Do you have a money habit you would like to share with us? Tweet @jointhepurse

Invest in something that you are naturally drawn to or interested in. Commit to learning as much as you can about it.

But don’t wait to become an expert before you invest.

Remember there is never a ‘perfect time to start’. It is better to take small steps and invest small amounts consistently over time, than to wait for the ‘perfect moment’.

Whilst it’s critical that our money grows and compounds over time, our education about the markets and how to invest our money is just as valuable, if not more so.

We can make better financial decisions over time.

Caught Our Eye

New digital tools and cool stuff for managing your money

The Big Exchange: (UK)- is a unified financial community which inspires permanent, positive change. Their mission is to create, promote and advance an inclusive financial system in the UK, with the intention that it delivers a positive social and environmental impact.

To measure impact, they have created a methodology where they will look in detail at each investment and see how much positive impact it has.

They are due to launch an impact investing platform in the UK and they will offer an ISA, GIA and a JISA. (Disclaimer: this is for information purposes only).

We’re Applauding

Female role model in politics, finance, business, money, or investment

We’re big fans of banking veteran and entrepreneur/CEO Anne Boden. She founded Starling Bank in 2014, and has built a successful challenger bank in the UK.

Anne is the former Chief Operating Officer of Allied Irish Banks (AIB). Born is Wales, Anne previously held senior roles in Royal Bank of Scotland, ABN AMRO and insurer AON.

Anne has received an MBE for her services to FinTech and sits on the FinTech Delivery Panel for UK tech network Tech Nation and speaks at key industry events like Money20/20 and Wealth 2.0.

In 2018, Starling Bank carried out linguistic research into 300 articles and they uncovered huge discrepancies between how men and women are spoken to about money. This led to a ‘Make Money Equal’ campaign (#makemoneyequal).

What We’re Reading

We’re reading Anne Boden’s The Money Revolution: transform the way you think about money in this easy-to-use, jargon-free guide which busts commonly held financial myths, helping you to get the most of your cash in today's digital world.

Coffee Break? Read This

Female portfolio managers made almost $200K less than their male peers

Fighting the tyranny of ‘niceness’: why we need difficult women

TED talks to remind you that your story isn’t over (after a setback)

We’d love to hear from you. Do you have feedback? Have we missed anything? What would you like to see more of? Get in touch with Jana via the The Purse website or tweet @jointhepurse and @janicka.

The Purse Ltd. Copyright 2020 & All Rights Reserved.