Weekly newsletter for women who want to be smart about money: financial news, personal finance and investing

Welcome to our #34 weekly newsletter in 2020.

Every week we curate key content and apply a female-lens so you can stay informed and inspired about money and investing.

Stay in the know.

Keep on top of global economic, financial and investing news and trends. And read about what this means for you and your money in 2020 during Covid-19 and beyond.

If you’re short on time, listen to the editorial on audio for a brief overview.

“Our mission is to help women take control of their financial future”

-Jana Hlistova

From The Purse…

Editorial from the Founder

The Federal Reserve has warned that the coronavirus will weigh heavily on the economy and China has injected $101bn into their financial system.

UK debt has hit £2trn for the first time since 1960, which means that national debt is now 100.5% of GDP.

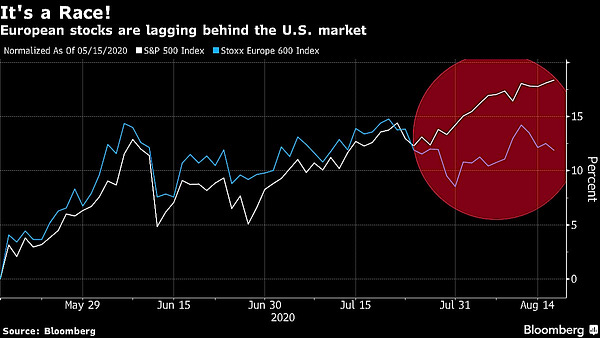

The S&P 500 hit an all-time high but investors are betting on European stocks which are lagging behind. The tech/growth trade is now the biggest bubble in at least 50 years.

Meanwhile bitcoin rose above $12,000, as low interest rates and the risk of inflation means that investors are hedging with bitcoin and gold.

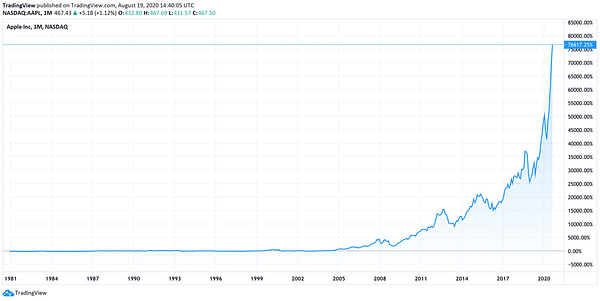

Apple became the first US company to reach a $2trn market cap and Tesla has hit $2,000 a share after a 378% rally this year.

We spotlight what has driven Apple’s growth.

And in the Have You Seen This Section? we highlight how the pandemic has made the gender pay gap worse.

We’re tracking the DeepTech Investing Report (and overcoming the double bias for women investors) and watch the TED talk by the late Sir Ken Robinson about whether schools kill creativity?

Stay safe, look after yourselves and your loved ones.

I hope you enjoy this week’s newsletter. Until next week,

Jana

The Big Picture

Global markets and economy news, trends and indicators

The Coronavirus Effect:

The Fed warns the coronavirus will weigh heavily on the economy

The US central bank noted:

“Uncertainty surrounding the economic outlook remained very elevated, with the path of the economy highly dependent on the course of the virus and the public sector’s response to it”.

The recent pick-up in employment has slowed since mid-June (and growth/job creation is heavily dependent on tackling the virus).

China injected an additional $101bn into their financial system

This is regarded as more ‘accommodative monetary policy’ from the Chinese government.

Interest rate cuts could follow or other ‘easing’ methods to stimulate the economy.

UK debt hits £2trn for the first time (since 1960-1961)

National debt is now 100.5% of GDP.

The crisis has put the government under significant strain.

Analysts believe the worst is yet to come (eg the furlough scheme ends in October).

Inflation increased to 1% in July vs 0.6% in June. Why?

Due to pent up demand eg clothing, haircuts, road trips.

This is still below the Bank of England’s (BoE) 2% target.

US jobless claims rise again in mid-August

Claims are above 1m again (vs expected 923,000).

S&P 500 hits new record high (on Tuesday)

The US index has skyrocketed more than 54% since March 23.

These gains are driven by Big Tech gains (eg Apple and Amazon).

The equity markets are reflecting the massive fiscal and monetary injections over the last 4 months.

European stocks are lagging behind US equities which are trading at all time highs:

Bitcoin flies above $12,000 (last Monday)

The most popular cryptocurrency has rallied more than 200% since March.

Low interest rates and the risk of inflation means that investors are hedging with bitcoin and gold.

Future Focus

Keeping an eye on key predictions, innovations and what’s going to impact the future

US: JP Morgan pinpoints the triggers for a bond sell-off (that can cause large losses)

If central banks extend their historic stimulus programmes, the result could be a giant market sell off, as investors react to the possibility that rates will stay at zero (for longer than it appears today).

This could be ‘disruptive’ for safety and defensive-oriented investments.

Cyclical stocks and oil prices are likely to rise in this case.

Michael Novogratz says buy bitcoin not gold

The founder of Galaxy Digital Holdings and veteran Wall Street investor has said:

he sees gold climbing above its record highs but bitcoin is still the more worthy investment because it’s “harder to buy” than the traditional haven.

“It’s only got a $20 billion market cap, while gold is over $10 trillion,” so bitcoin still has a long way to go.

beginners should not put in more than 1-2% of their money into crypto.

So far this year, bitcoin, the largest cryptocurrency, has slid below $4000 and surged above $12,000 (last week).

Tech/growth trade is now the biggest bubble in at least 50 years

The question everyone is asking: when will the bubble burst?

Your Money

Insights, trends and what this means for you and your purse

UK: how to prepare your finances for this uncertain period

Diversification: increase your income sources

Strip back on expenses

Get aggressive on your savings

Create a budget and stick to it.

Millennial women share how they spent their money during lockdown

Conscious consumerism

Seesaw spending

‘Treat yourself’

Companies: winners & losers

Companies to watch and share price movements

Apple becomes the first US-listed company to reach $2trn market cap

This is two years after it became the world’s first trillion-dollar company.

Even during the pandemic, Apple’s share price has surged 60%.

Shares of the technology giant rose 1.2% to an all-time high of $467.84 on Wednesday to reach the milestone.

Tesla now hits $2,000 a share after a 378% rally this year. Tesla is now up 40% since announcing the stock split:

Barrick Gold surged 12% after Warren Buffett’s Berkshire Hathaway bought a stake

This is a surprise as Buffett has been critical of gold (in the past) saying it has ‘no utility’.

Berkshire Hathaway 21 million shares of the gold and copper miner worth roughly $564 million in the last quarter.

In the Spotlight

Is there a topic you'd like us to Spotlight? Please tweet @jointhepurse

What’s driven Apple’s growth?

Last Wednesday, Apple became the first US company to achieve a $2trn market cap valuation, just 2 years after it was valued at $1trn.

The tech company, co-founded by Steve Jobs to sell personal computers and iPhone maker, hit a share price of $467.77 (to reach the milestone).

Apple had expected to take a hit during the pandemic which is why it issued a revenue warning and withdrawing financial guidance in February.

Instead, the share price has risen 50% since March; adding more than $1trn to its value.

Since Jobs passed away in 2011, CEO Tim Cook has bet the company on moving away from being too dependent on the iPhone. He has seen a nine-fold increase in the Apple share price since he took over.

It is Apple’s move in services and wearable products that had paid off-adding more than $13bn in the last quarter.

The company launched Apple TV and even launched a credit card and Apple Pay (used by more than 400m people).

However Apple has been criticised for its attitude towards paying corporate tax.

Have You Seen This?

Female-focused news, reports, research, campaigns

UK: Women in banking are treated differently

Former Virgin Money boss Dame Jayne-Anne Gadhia who left to set up fintech startup called Snoop, says she was labelled a ‘bloody difficult woman’ throughout her career.

The Treasury launched the Women in Finance Charter as a result of a government review which considered women’s representation in financial services led by Gadhia.

Know this: the financial services industry has the biggest gender pay gap. Whilst the median pay gap in the sector is 28% (UK), HSBC Bank has a gender pay gap of 55.1% and Lloyds Bank has a gender pay gap of 34.9%. Note that the gender bonus gap is far greater: in the case of HSBC it is 60% whilst it is 71% at Santander. What this demonstrates is that there are still very few women in senior positions in financial services. And this has a significant impact on a woman’s purse, and therefore her net worth. (The UK average gender pay gap across all industries is 17.3% (2019), and this is likely to have declined further during the pandemic).

US: How the pandemic is making the gender pay gap worse

This recession is hitting women harder.

Between February and April 2020, male unemployment increased 9.9%; female unemployment increased 12.8%.

The unemployment rate is only part of the story:

"This recession is not just a labor market shock, but it's also a huge shock to the requirements for time spent at home"

Women are now more likely to drop out of the labor force or cut hours, hurting their future job prospects.

Economists predict that this will widen the gender pay gap: from women earning 83 cents for every average man’s dollar, to earning 76 cents for every average man’s dollar.

They also predict it may take 10 years to close the gender pay gap to what it was before the pandemic.

Read this study: This Time It’s Different: The Role of Women’s Employment During the Pandemic Recession

Know this: Harvard University's Claudia Goldin, finds that the primary driver of the gender wage gap is ‘female demand for temporal flexibility’. Breaking down the barrier in how we work by offering flexibility and remote working in high-paying jobs for women (beyond the pandemic) will help close the gender pay gap (especially once children go back to school). However, we also know that employers must get better at developing a company and team culture which does not differentiate or ‘discriminate’ between flexible or remote workers-so women really don’t miss out if they work from home. The other obvious solution is for partners to more equally share in the childcare and household chores.

What We’re Tracking

Female-focused products or services, start-ups and businesses led by women, investment and research.

DeepTech Investing Report: overcoming double-bias for women investors

About 16% of decision-making partners at DeepTech VC (venture capital) firms are women.

DeepTech is compounded by structural barriers and barriers challenging women in STEM.

Women in DeepTech are often sole GPs (general partners) and are highly educated (with at least 2 degrees).

Women sole GPs receive less capital than men sole GPs — despite being almost twice as likely to have an advanced technical degree and more than twice as likely to have a PhD.

Network bias could explain why women GPs have a harder time raising capital in general.

More than 55% of all-women VCs raise funds of less than $25M, compared to just 30% of all-men VCs. And, almost no all-women DeepTech teams raise more than $100M.

Money Habits of the Week

Do you have a money habit you would like to share with us? Tweet @jointhepurse

Do some research this week on how much more you could get paid for your job and skills.

Reach out to recruiters and headhunters and find out the maximum you could get paid.

Consider how you might up-skill to negotiate more money.

Apply for new work or a new job and negotiate a higher rate or salary.

Armed with this information negotiate for more with your existing employer or client.

What We’re Watching

Sir Ken Robinson is a creativity expert who challenges the way we’re educating our children. He champions a radical rethink of our school systems to cultivate creativity and acknowledge multiple intelligence systems.

Watch this TED talk: Sir Ken Robinson makes an entertaining and profoundly moving case for creating an education system that nurtures (rather than undermines) creativity.

We celebrate Sir Ken Robinson, who sadly passed on Friday, 21 August 2020 after a short battle with cancer.

Coffee Break? Read This

If you can’t take a vacation, get the most out of minibreaks

Making jokes during a presentation helps men but hurts women

Female-led countries handled coronavirus better, research says

We’d love to hear from you. Get in touch with Jana via the The Purse website or tweet @jointhepurse and @janicka.

The Purse Ltd. Copyright 2020 & All Rights Reserved.

Share this post