Weekly newsletter for women who want to be smart about money: financial news, personal finance and investing

Welcome to our #27 weekly newsletter in 2020.

Every week we curate key content and apply a female-lens so you can stay informed and inspired about money and investing.

Stay in the know.

Keep on top of global economic, financial and investing news and trends. And read about what this means for you and your money in 2020 during Covid-19 and beyond.

If you’re short on time, listen to the editorial on audio for a brief overview.

“Our mission is to help women take control of their financial future”

-Jana Hlistova

Photo: Bruce Mars

From The Purse…

Editorial from the Founder

The global stock market was up 18% at the end of the second quarter, the biggest surge in 11 years. The FTSE 100 index had its best quarter since August 2010.

Ray Dalio, in an interview with Bloomberg has warned that the Federal Reserve is artificially inflating asset markets and the US dollar is at risk of being displaced as the world reserve currency.

Christine Lagarde, president for the European Central Bank, said that recovery from the pandemic will be asymmetric, transformational ‘but the hardest is yet to come’.

The time is now for investing in a green economy, according to Joseph Stiglitz, who argues that investments in a green transition will create a healthier and more sustainable economy.

We spotlight what sustainable investing is and share findings from a survey by Morgan Stanley.

Tesla is now the largest car maker by market cap valued at $210bn.

According to research, women who divorce have a quarter of the pension pot divorced men do. A pension is the second most valuable asset after a property but it is often ‘forgotten’ and women stand to lose unless they negotiate.

Women entrepreneurs could turbocharge an economic recovery in the EU post-pandemic. We think that probably applies the world over.

And we’re tracking female-led startups: The Mom Project, Mirror and Lay London all making waves (we can’t stop looking at Lay London’s instagram).

Watch the TED talk on economic value by a leading economist and read about how to stop obsessing over your mistakes.

Stay safe, look after yourselves and your loved ones.

I hope you enjoy this week’s newsletter. Until next week,

Jana

The Big Picture

Global markets and economy news, trends and indicators

The Coronavirus Effect:

China’s service sector bounces back:

Chinese companies reported their strongest growth in a decade (since August 2010). Business activity has risen since May.

China has become ‘a proxy’ for how fast economies can expect to recover from the pandemic.

UK GDP slump in the first quarter is the biggest since 1979:

The British economy shrunk 2.2% in the first quarter (Jan-Mar) vs the projected 2%.

US added 4.8m jobs in June:

The unemployment rate fell to 11.1% in June.

This is the second consecutive month of growth after more than 20 million jobs were wiped out in April during the pandemic lockdown.

However new infection surges means that the economy is still fragile.

Eurozone unemployment at 7.4% vs the projected 7.7% in May:

The unemployment rose less than expected in May which indicates the government measures (eg furlough schemes) are successful.

Euro-27 unemployment is at 6.7% for June.

Global stock markets surge:

the MSCI All Country World Index is up 18% in the second quarter (Apr-June), the biggest advance in 11 years.

The financial markets recovery reflect the huge stimulus packages, low interest rates and central banks printing money.

However there is concern that valuations are too high.

FTSE 100 index has best quarter since 2010:

It ended 8.8% higher for the second quarter (Apr-Jun).

Future Focus

Keeping an eye on key predictions, innovations and what’s going to impact the future

The recovery from the pandemic will be asymmetric, transformational but ‘the hardest is yet to come’

Christine Lagarde, president for the European Central Bank, joined women economists at the United Nations ‘Rebirthing the global economy to deliver sustainable development’ online conference.

She cautioned that the recovery from the pandemic will not be easy.

Investing in a green economy can help us recover from the pandemic

According to Joseph E Stiglitz, a Nobel laureate in economics, now is the time for people to demand that companies contribute to social and racial justice, improved health and a shift to a greener, more knowledge-based economy.

Stiglitz argues that these values should be reflected in how public money is spent and in how recipients can use that money.

Investments in a green transition will create a healthier and more sustainable economy.

US: ‘The capital markets are not free markets allocating resources in the traditional ways’

In an interview with Bloomberg Thursday, Ray Dalio warned that the Federal Reserve is artificially inflating asset markets, normal valuation metrics no longer apply and the US dollar is at risk of being displaced as the world reserve currency.

It’s no secret that central banks and governments around the world are propping up the economy: they are printing money, purchasing government and corporate bonds within a low interest environment.

This explains why we are seeing a stock market largely disconnected from the global economy.

Your Money

Insights, trends and what this means for you and your purse

How to protect your pension and investments during a stock market panic

Stock markets usually rebound after a shock once immediate issues are resolved.

Stock markets usually trend upwards but it’s not uncommon for them to fall by 10% over short periods.

It’s important investors avoid panic selling.

UK: record fall in household spending

‘Households’ consumption spending decreased by £9.5 billion (negative 2.7%) in Quarter 1 2020, the largest quarterly fall in nominal household spending of this type ever recorded’

UK: one in 20 people cut or pause pension contributions

Economic uncertainty and pay cuts means that people reduce their long term savings.

The Institute of Fiscal Studies (IFS) research: the impact of coronavirus on household finances and financial distress. The key highlights include:

The crisis has so far impacted the earnings of the poorest households the most.

Non-payment of household bills increased sharply after lockdown, and increased further between April and May.

In some cases, these unpaid bills will be important and sensible ways of weathering the storm, but they still mean additional debt that will be carried forward.

Companies to Watch: winners & losers

Companies to watch and share price movements

Tesla is now the world’s largest carmaker by market cap, valued at $210bn:

No more burgers? Byron to go into administration

The chain and its owners are said to be confident a pre-pack sale can be arranged before mid-July, meaning they will attract a buyer of the business (or parts of the business).

Last year the company recorded a turnover of £70.9m, with a gross profit of £31.6m.

In the Spotlight

Is there a topic you'd like us to Spotlight? Please tweet @jointhepurse

What is sustainable investing?

This is where social and environmental impact is considered alongside financial returns, when investing in companies or funds.

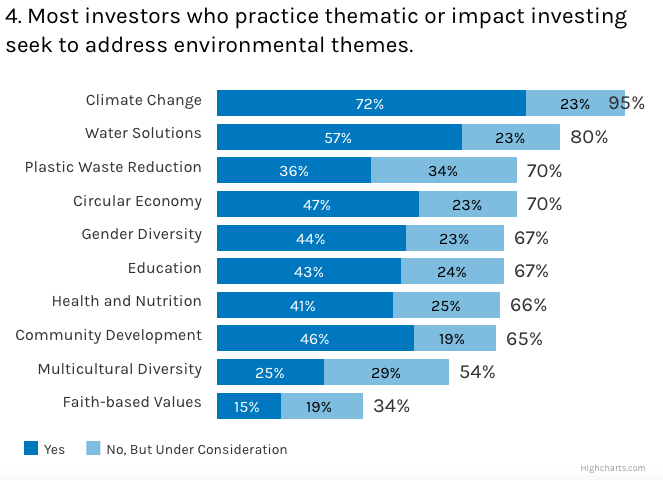

According to a survey by Morgan Stanley, most institutional investors have a preference for the following themes (climate change comes out on top):

Areas of interest for investors: gender diversity is at 44%, multicultural diversity is at 25% vs climate change at 72%.

8 in 10 investors believe that companies with strong ESG practices will have better long term returns. (Research proves that ESG funds outperform traditional funds).

Source: Morgan Stanley

Have You Seen This?

Female-focused news, reports, research, campaigns

EU report: women entrepreneurs could fuel economic recovery post-pandemic

If more women are encouraged to work and to start businesses:

10.5 million jobs could be created by 2050

This could boost the EU economy: €1.95trn to €3.15trn.

Know this: women-owned startups have a higher return on investment. Financial backers should regard women founders as a better bet. But women still only get less than 3% in venture capital funding globally.

Now: Pensions report: divorced women retire on a quarter of men’s retirement pots

On retirement, divorced women’s pension pot is £26,100 versus £103,500 for men who have divorced.

For couples who stay married, women’s pension is equal to £51,000 and men’s pension pot is £156,500.

Working part-time has the biggest impact on women’s pension pot.

Introducing ‘fairer pensions’ will help close the gender pension gap for women.

Know this: A pension is the second most valuable asset after the family home and should be negotiated during divorce proceedings. Women need to save for retirement as a priority because they live longer and their retirement costs are higher. And we agree: the government needs to introduce ‘fairer pensions’ to help close the gender pension gap.

What We’re Tracking

Female-focused products or services, start-ups and businesses led by women, investment and research.

The Mom Project: (US), co-founded by Allison Robinson in 2016, connects women and parents to organisations. It seeks to help employers become more inclusive by accessing a diverse pipeline of highly skilled (mostly female) talent.

The startup has just raised $25m and Serena Williams is a strategic adviser.

The platform has grown from 75,000 users to 275,000 and 2000 employers have posted a job.

The Mom Project has acquired a people analytics platform called Werks.co which is focused on building a better workplace for all.

In a recent survey the company said that women are twice as likely to leave their employer within a year of the pandemic.

Mirror: (US), founded by Brynn Butnam in 2016, is a home exercise startup and it has just been acquired by Lululemon for $500m. Never heard of Mirror? Don’t worry, neither had we. But exercising at home is all the rage, especially when pandemics strike (ahem).

The New York startup’s guided workout machine costs $1,495 and allows you to stream on-demand workouts and classes.

Lululemon invested $34m late last year and Mirror had raised $74.8 million from other investors, including Karlie Kloss.

Female Ventures Fund (FVF) to invest £10m in female founders in the first year

The Seed Enterprise Investment Fund wants to address the historical inequality of only 1% of venture capital going to female founders.

FVF already has 35 companies signed up in its portfolio including a sustainable fashion brand marketplace.

Lay London: (UK), is a rental, table laying company founded by sisters Alice and Jemima Herbert. Launched last year, they are catching on to a big trend #tablesetting. Check out their Instagram-we’re kinda obsessed!

Money Habits of the Week

Do you have a money habit you would like to share with us? Tweet @jointhepurse

Money invested early through the magic of compounding grows on its own making you wealthier by the year.

When you start to invest, you are buying yourself time. And a life.

Commit to your money goals and values. Decide how you’re going be consistent and who can help you on your journey. Stay curious and keep learning.

Remember-investing doesn’t have to be something you do on your own.

Find your tribe and connect.

What We’re Watching

Mariana Muzzucato is a leading economist who helps policymakers understand how the global economy really works (and how we need to fix it).

Watch this TED talk about where wealth comes from, who creates it and what destroys it.

Coffee Break? Read This

The US is now home to 800 billionaires, worth over $3.4 trillion

New evidence suggests women get kinder but less honest feedback at work

In a Covid-19 environment, you can have a kid or a job. You can’t have both

We’d love to hear from you. Get in touch with Jana via the The Purse website or tweet @jointhepurse and @janicka.

The Purse Ltd. Copyright 2020 & All Rights Reserved.

Share this post