The UK and EU markets have had their worst week since 2008, how does this compare to the financial crisis, what does this mean for your money, we're tracking Stitch Fix and check out the Moneybox app

Weekly newsletter for women who want to be smart about money: financial news, personal finance and investing

Welcome to our #11 weekly newsletter in 2020.

Every week we curate key articles and content so you can stay informed and inspired about money and investing without the boring bits!

This is your weekly go-to place to read up on all things money-related.

We spend hours sifting through content every week and apply a female-lens to news and content about money and investing so that it is meaningful to you.

Ultimately we want to support you in making well-informed financial decisions, grow your net worth and ensure your financial security.

From The Purse…

Editorial from the Founder

In these very uncertain times with volatile global markets, it is useful to slow down and really understand what is going on.

Specifically, take some time to study the building blocks or the levers in the economy and how things change which cause the markets to fall or swing upwards.

In general, investors are looking for governments to take action-in the form of either decreasing interest rates, injecting liquidity or providing fiscal support, in the form of tax credits to businesses, for example.

The impact of the coronavirus on the economy is fast becoming entrenched. Businesses in the travel, retail, hospitality and energy sector are feeling the strain.

And this is why economists are forecasting a global recession in 2020.

Whilst we may all feel the pinch, especially if we look at our retirement funds or investment portfolios, it’s best to avoid panicking or panic selling.

It is also likely you will find some bargains: businesses currently trading at a highly discounted rate.

Take care of yourself and your loved ones.

I hope you enjoy this week’s newsletter. Until next week,

Jana

The Big Picture

Global markets and economy news, trends and indicators

‘Coronavirus mania’ continues: it has been another difficult week for investors and savers alike:

“Savers with cash in the bank were struck with news of interest rate cuts and investors experienced the worst stock market since the 1987 market crash and the financial crisis in 2008.”

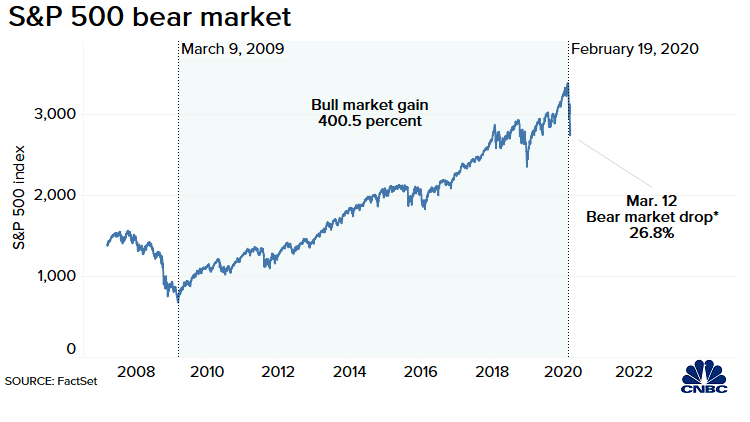

On Monday, stock markets suffered their worst fall since the 2008 financial crisis as the coronavirus triggers panic selling. Trillions of pounds are wiped off the global stock markets.

The FTSE 100 plunged by 7.7% led by a slump in the energy sector. This put the Footsie into a bear market (ie down by 20% since January).

Wall Street briefly suspended trading for 15mins after falling 7%.

It is the biggest single fall since the start of the first Gulf war in 1991.

The UK and EU markets have had their worst week since 2008.

The FTSE 100 fell by 17% this week, the worst performance since Lehman Brothers failed. However on Friday, 13 March the FTSE 100 rallied 2.46%.

On Thursday, the FTSE 100 fell by 10.9% which is the worst fall since the 1987 market crash.

It is estimated that the FTSE 100 lost £ 275bn this week alone, and over £500bn in the last 3 weeks.

Global stock markets lost $4trn in market capitalisation this week: one of the worst weeks on record for financial markets:

The Bank of England (BoE) cut interest rates on Wednesday by half a percent point to 0.25%.

“The reduction in the bank rate will help to support business and consumer confidence at a difficult time, to bolster the cash flows of businesses and households, and to reduce the cost, and to improve the availability, of finance,” the bank said.”

UK growth to be the slowest since 2009: predicted to grow 1.1% this year

£30bn package introduced to combat coronavirus

Entrepreneurs' Relief will be retained, but lifetime allowance will be reduced from £10m to £1m

£640m "nature for climate fund" to protect natural habitats in England, including 30,000 hectares of new trees.

The US stock market had the best day on Friday since 28 October 2008, surging 9%.

On Friday, Donald Trump declared a national emergency to combat the coronavirus and the National Designation emergency will mean $50bn in funding will be available.

On Thursday, Trump introduced a 30 day travel ban on 26 European countries (except for the UK/Ireland until this Monday).

Looking Ahead in 2020

Economists are forecasting a global recession.

Downward pressure on earnings means companies will be increasingly unable to pay their debt-with the energy, airline, travel and retail all caught up in the a coming wave of stress.

Coronavirus Impact: Your Money

Insights, trends and what this means for you and your money

The stock market is tanking. Do. Nothing (The Atlantic)

The market is moving. Most people should sit still. (The New York Times)

Your money and the coronavirus: you asked and experts answered (The New York Times)

Investor psychology tips for surviving Covid-19 (The Irish Times)

How will the stock market fall affect my personal finances? (The Guardian)

Why the coronavirus fallout may be worse for women than men. Here’s why (World Economic Forum)

In the Spotlight

Is there a topic you'd like us to Spotlight? Please email jana@jointhepurse.com or tweet @jointhepurse

How is this market different to the financial crisis in 2008?

The market upheaval we are experiencing at the moment is due to the erosion of three pillars:

Coronavirus impact: the supply and demand is being destroyed. This is undermining global economic growth.

The central banks are no longer seen as effective in controlling financial volatility ie lower interest rates and injections of liquidity. In Europe, policy interest rates are already negative.

Saudi Arabia’s decision to launch an oil price war, has put pressure on small oil companies and is undermining parts of the corporate bond market.

Asset prices have begun to fall and because this is happening in a ‘disorderly manner’ which is having a real impact on the financial markets and the economy.

Eventual recovery will be fuelled by low mortgage rates and energy prices. This will drive an increase in how much consumers spend.

Have You Seen This?

Female-focused news, reports, research, campaigns

Budget 2020: what it means for women- from the tampon tax to sick pay

Female SME founders less likely than male entrepreneurs to seek external finance

According to the research, undertaken jointly by The Entrepreneurs Network and The Enterprise Trust, almost one in ten (9.3 per cent) of SME’s are not seeking the external capital that would allow them to grow.

What We’re Tracking

Female-focused products or services, crowdfunding campaigns, start-ups and businesses led by female entrepreneurs & investment, research

8 standout companies run by women. These firms have all carved out competitive advantages that should allow them to thrive for the next decade or more.

Stitch Fix (US): is an online personal styling service in the United States. Founded by CEO Katrina Lake, raised $43m in funding, IPOed Stitch Fix on the NASDAQ at the age of 34 and has achieved $1.2bn in revenue.

Love this beautiful cover of badass boss Katrina Lake @kmlake. StitchFix raised $43M funding, Kat IPO’ed at age 34 (and rang the NASDAQ bell w/her toddler on her hip), and is doing $1.2B in revenue. An inspiration to founders and working women everywhere. fastcompany.com/90298900/stitc…

Love this beautiful cover of badass boss Katrina Lake @kmlake. StitchFix raised $43M funding, Kat IPO’ed at age 34 (and rang the NASDAQ bell w/her toddler on her hip), and is doing $1.2B in revenue. An inspiration to founders and working women everywhere. fastcompany.com/90298900/stitc…

Founded in 2011, Stitch Fix went public in 2017. Immediately after the initial public offering, Stitch Fix was valued at $1.6 billion. As of February 2018, the company was valued at $2 billion

On Monday, Stitch Fix reported second-quarter sales for fiscal 2020 that missed analysts’ estimates.

It issued a disappointing outlook for the year.

Net revenue increased to $451.8 million from $370.3 million a year ago. That missed expectations for $452.5 million.

The clothing service reported active clients of 3.5 million, up 17% year over year, and slightly better than what analysts were anticipating.

Money Habits of the Week

Do you have a money habit you would like to share with us? Tweet @jointhepurse

“It’s not about timing the market but time in the market”

It is impossible to predict or time the market. Therefore investing your money on a consistent basis every month is crucial.

Caught Our Eye

Digital tools for managing your money and investing

Moneybox: (UK)- digital savings and investment app-you can round up your everyday purchases to the nearest pound and set aside your spare change, whether it is from last night’s Uber or this morning’s coffee.

Sign up in minutes via your mobile, start with as little as £1 and save/invest your spare change.

And now you can set up a SIPP (self-invested personal pensions plan) via a choice of three tracker funds. These are:

BlackRock LifePath fund – a ‘lifestyle’ fund that de-risks investments as you near retirement

Fidelity World Index fund (63% in US, investing in stocks such as Apple, Microsoft, Amazon and Facebook)

Old Mutual World ESG Index fund – socially responsible investment option (63% in US, investing in stocks such as Microsoft, Alphabet, Johnson & Johnson and Procter & Gamble)

Investors can start saving with £1 and charges for the pension include a 0.45% annual platform fee for balances up to £100,000 (0.15% for balances above). Fund provider costs range from 0.12% to 0.30%.

Disclaimer: this is for information purposes only.

We’re Applauding

Female role model in politics, sport, finance, business, money, or investment

We are celebrating Cindy Parlow Cone, the new President of US Soccer Federation.

What We’re Reading

Capital in the Twenty-First Century: "It seems safe to say that Capital in the Twenty-First Century, the magnum opus of the French economist Thomas Piketty, will be the most important economics book of the year-and maybe of the decade." -Paul Krugman, New York Times

Coffee Break? Read This

Work like a woman: meet the leaders of London's investment scene

Interview: Sheryl Sandberg on powerful women, getting engaged and coming under fire in Facebook

The coronavirus is creating a huge stressful experiment in working from home

We’re about to learn a terrible lesson about the coronavirus: inequality kills

We’d love to hear from you. Do you have feedback? Have we missed anything? What would you like to see more of? Get in touch with Jana via the The Purse website or tweet @jointhepurse and @janicka.

The Purse Ltd. Copyright 2020 & All Rights Reserved.