Weekly newsletter for women who want to be smart about money: financial news, personal finance and investing

Welcome to our #41 weekly newsletter in 2020.

Every week we curate key content and apply a female-lens so you can stay informed and inspired about money and investing.

Stay in the know.

Keep on top of global economic, financial and investing news and trends. And read about what this means for you and your money in 2020 during Covid-19 and beyond.

If you’re short on time, listen to the editorial on audio for a brief overview.

“For women who are taking control of their financial future”

-Jana Hlistova

From The Purse…

Editorial from the Founder

Global equity markets continue to churn.

According to strategists at MRB Partners: ‘the stock markets are caught between hopes for a better economic future, yet struggling with a still-unchecked pandemic and signs that the economic rebound is fading’.

UK’s credit rating has been downgraded by Moody’s based on low growth, high debt and a fractious policy environment.

On Friday, British Prime Minister, Boris Johnson said that the UK will leave the EU without a trade deal. Many regard Johnson’s comments as ‘political posturing’.

US retail sales jumped 1.9% in September, exceeding the forecast by 0.7%. Are Americans spending their ‘free money’?

Meanwhile two Covid-19 trials (by US pharmaceutical firms) have been paused due to safety concerns.

And the world’s stockpile of negative-yielding debt has soared to $16.3tn, the highest since April 2019. As negative-yielding debt goes up, so does the price of Bitcoin.

In fact, according to ex-Goldman Sachs, hedge fund chief, Raoul Pal, Bitcoin will increase to $1m in 5 years.

Read about why US personal finance guru, Suze Orman says that an emergency fund is a critical part of your investment portfolio.

We spotlight how investors are protecting their money from low returns.

And in the Have You Seen This? section, read about how the gender savings gap has widened during the pandemic.

We’re tracking Ada’s Ventures: a London-based venture capital firm which launched its £250,000 angel investment programme, targeting 'angels’ from diverse backgrounds.

Listen to my podcast interview with Matthew Stafford, the co-founder of 9Others and Dot Matrix Group. We talk about how you can invest in startups through an angel syndicate and much more.

If you have time, watch the TED talk with Tom Rivett-Carnac about how to shift your mindset to change your future. Tom works at the highest levels of business and government to find creative ways to accelerate solutions to the climate crisis.

Stay safe, look after yourselves and your loved ones.

I hope you enjoy this week’s newsletter. Until next week,

Jana

The Big Picture

Global markets and economy news, trends and indicators

The Coronavirus Effect:

Global equity markets continue to churn

According to strategists at MRB Partners:

‘the stock markets are caught between hopes for a better economic future, yet struggling with a still-unchecked pandemic and signs that the economic rebound is fading’.

‘Unprecedented policy actions have supported economic activity and boosted risk asset prices, but are not sufficient to generate a self-reinforcing economic expansion’.

UK’s credit rating has been downgraded by Moody’s

‘Moody’s said it believed growth would be ‘meaningfully weaker’ than it had previously believed..’

This is based on UK’s low growth, high debt and fractious policy environment.

They estimate a sharper peak-to-trough contraction for the UK economy compared to other G20 economies.

UK Prime Minister, Boris Johnson says the UK is preparing to leave the EU without a trade deal

The nation is preparing for an Australian-style trade deal with the EU.

However many see Johnson’s comments as political ‘posturing’. Discussions are set to continue.

The pound struggles for direction.

US retail sales jumped 1.9% in September (exceeding estimates by 0.7%)

Excluding autos, sales were up 1.5%.

Both Dow and the S&P 500 increased their third straight weekly gain and the Nasdaq posted a four-week winning streak.

Two Covid-19 trials halted on safety concerns

US pharmaceutical companies, Johnson & Johnson and Eli Lilly announce pauses which dashes hopes for pandemic ‘cure’.

Negative-yielding debt is a positive for Bitcoin

The world’s stockpile of negative-yielding debt has soared to $16.3tn, highest since Apr 2019 and just $800bn shy of an all-time high.

As the volume of negative yielding debt goes up, so does the price of Bitcoin.

Future Focus

Keeping an eye on key predictions, innovations and what’s going to impact the future

The global economy is now projected to contract by 4.4% (vs the forecast -4.9% in June). In 2021, the IMF sees growth of 5.2% (down from 5.4%).

The US economy is set to fall by 4.3% this year.

The economy in the UK, France, Italy and Spain is expected to contract by approximately 10%.

US: Vaccine developments most important to stock market

According to Goldman Sachs, finding a breakthrough vaccine for Covid-19 is more important to investors than the US elections or the Q3 earnings reports.

Finding a viable vaccine is the best way to bring stock fundamentals back to pre-pandemic highs.

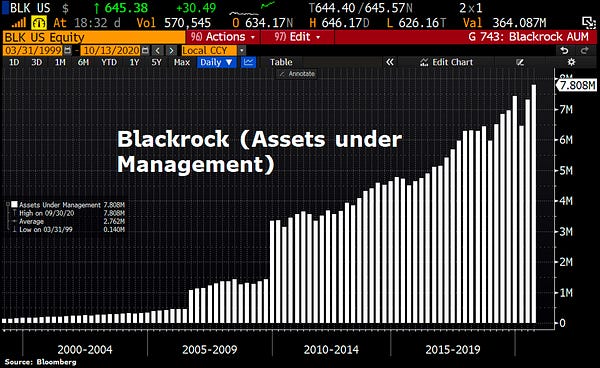

BlackRock: the ETF company has $7.8tn in assets under management; a +12% YoY.

BlackRock said that iShares raked in $2.3tn in assets during Q3, nearly 70% of that total was for stock funds.

Bitcoin will surge to $1m in 5 years time (Raoul Pal)

According to ex-Goldman Sachs hedge fund chief Raoul Pal, Bitcoin will increase from $11,000 to $1m in 5 years.

Pal has allocated more than 50% of his capital to Bitcoin.

He said that institutional funds would adopt the digital currency because the economy will take a long time to recover from Covid-19.

Your Money

Insights, trends and what this means for you and your purse

An emergency fund is the most important piece to your investment portfolio

US personal finance guru, Suze Orman, has said that ‘a robust emergency fund is the most critical component for your investment portfolio.’

The coronavirus pandemic has laid bare the need to have money saved in the bank for unforeseen challenges.

Suze advocates that everyone should have 8-12 months of expenses saved in their emergency fund.

Companies: winners & losers

Companies to watch and share price movements

JP Morgan beat analysts’ expectations, profits soar

Trading beat analysts’ expectations during the period, with revenues growing from $9.52bn to $11.5bn.

Profit increased from $2.83bn to $4.3bn.

ASOS profits increase during the pandemic

It made £142m in pre-tax profits in the 12 months to 31 August, up from £33m from 2019.

Young shoppers flocked to its site after high street clothes stores closed.

However, ASOS’s shares are down 6%:

it warned that its target market of younger consumers face disrupted ‘economic prospects and lifestyles’.

In the Spotlight

Is there a topic you'd like us to Spotlight? Please tweet @jointhepurse

How are investors protecting their money from low returns?

In a world where bonds return little or no interest, investors must look for alternative ways to make a return above the rate of inflation.

More worrying is the fact that over time government and high-quality bonds may register a negative return (as interest rates may become negative).

The growing concern (or likelihood) that we are entering an inflationary period explains why investment strategists are shifting into equities, commodities and alternative assets (such as Bitcoin or art), for higher returns.

According to BlackRock CEO, Larry Fink: ‘…The fixed income market will be substantially more of an ETF market in the future.’

The near-zero yield environment has awakened investors, who are now looking at actively managed fixed income (bond) ETFs.

In a yield-constrained world, investors will have to actively seek higher returns (as opposed to passively tracking an index).

Have You Seen This?

Female-focused news, reports, research, campaigns

The gender savings gap has widened as a result of Covid-19

According to research, women now have a third less saved.

Over a third of women (35%) admitted to dipping into their savings over the past six months, compared to just 15% of men.

The widest gender savings gap is among millennials, with women aged 23 to 38 reporting 60% less in savings than their male counterparts — a difference of £16,000.

Know this: the gender pay gap which currently stands at 17.3% in the UK. This means that women, on average, have less money left over every month to save (& to invest). However single parents, (and specifically women) carry the heaviest burden having to balance work, household chores and childcare during the pandemic. The important thing to remember is whilst you may not be able to save as much as you would like right now, you can keep track of your outgoings and make a plan for how you can make up the shortfall. Knowledge is power. So keep on top of where you are financially. Keep a money journal or use a mobile app to track your progress. Stay engaged with your money.

What We’re Tracking

Female-focused products or services, start-ups and businesses led by women, investment, crowdfunding campaigns and research.

Ada Ventures: (UK)-co-founded by Francesca Warner and Matt Penneycard, the London-based venture capital firm, named after the first computer programmer Ada Lovelace, has launched a £250,000 angel investor programme.

The aim is to create a new generation of investors who may have otherwise been excluded from the industry.

This new initiative was an evolution of the firm’s scout programme.

‘Ada’s Angels’ will be able to make five investments of £10,000 over the course of the next year. And the final investment will be a joint decision between the angel and Ada Ventures, and angels will receive 100 per cent of the carry on their £50,000.

Money Habits of the Week

Do you have a money habit you would like to share with us? Tweet @jointhepurse

We have been talking a bit about low or negative interest rates lately, and how this will impact your money.

The lower the interest rate, the lower the return you will get.

And as inflation continues to rise, the value of your money (savings) will be eroded.

There is increasing focus on actively managed fixed income (or bond) exchange traded funds (ETFs).

Look into what fixed income or bond ETFs are available.

Compare the fees for passive vs active ETFs. (Note that actively managed ETFs will be more expensive than passive ETFs).

Create a list of fixed income ETFs with the lowest fees.

Keep learning & stay engaged.

What We’re Watching

Tom Rivett-Carnac: is a political strategist focused on creating a better future. He works at the highest levels of business and government to find creative ways to accelerate solutions to the climate crisis.

Watch the TED talk about how to shift your mindset and change your future. When it comes to big life problems, we often stand at a crossroads: either believe we're powerless against great change, or we rise to confront climate change - or whatever crisis may come our way -and sustain the action needed to build a regenerative future. As he puts it: ‘stubborn optimism’ can fill our lives with meaning and purpose.

Coffee Break? Read This

Andreessen Horowitz publishes 'Crypto Startup School' documentary

Women executives say that the pandemic is exacerbating gender bias

We’d love to hear from you. Get in touch with Jana via the The Purse website or tweet @jointhepurse and @janicka.

The Purse Ltd. Copyright 2020 & All Rights Reserved.

Share this post