Welcome to our #215 weekly newsletter.

“For women taking control of their financial future”

-Jana Hlistova

From The Purse

In this week’s newsletter, we highlight the research by Carta which tracks the state of equity in the startup ecosystem (US). And whilst we are seeing overall improvement, women continue to be underrepresented in executive positions and receive a smaller slice of the equity pie.

It goes without saying that women owning less equity impacts how much personal wealth they can grow overtime.

And don’t forget to listen to The Purse Podcast interview with UK economist Vicky Pryce. We talk about the House of Lords report on the Bank of England and its ‘inflation failures’, what could they have done differently, the UK economy in review, what’s ahead in 2024 and CBDCs and bitcoin.

***

You can review the news in brief so you stay on top of global financial, economic and investing trends.

I hope you enjoy this week’s newsletter.

Until next week,

Jana

Carta report: women and equity in startups

Carta reports on the state of equity in the startup ecosystem (US). And women continue to hold minority positions at executive level and are awarded less equity.

Every year, Carta reports on the state of equity in the startup ecosystem (US). Over the past year, rising interest rates and a pullback in venture capital investment has made it harder for all founders. However this has had an outsized impact on women founders and founders of colour.

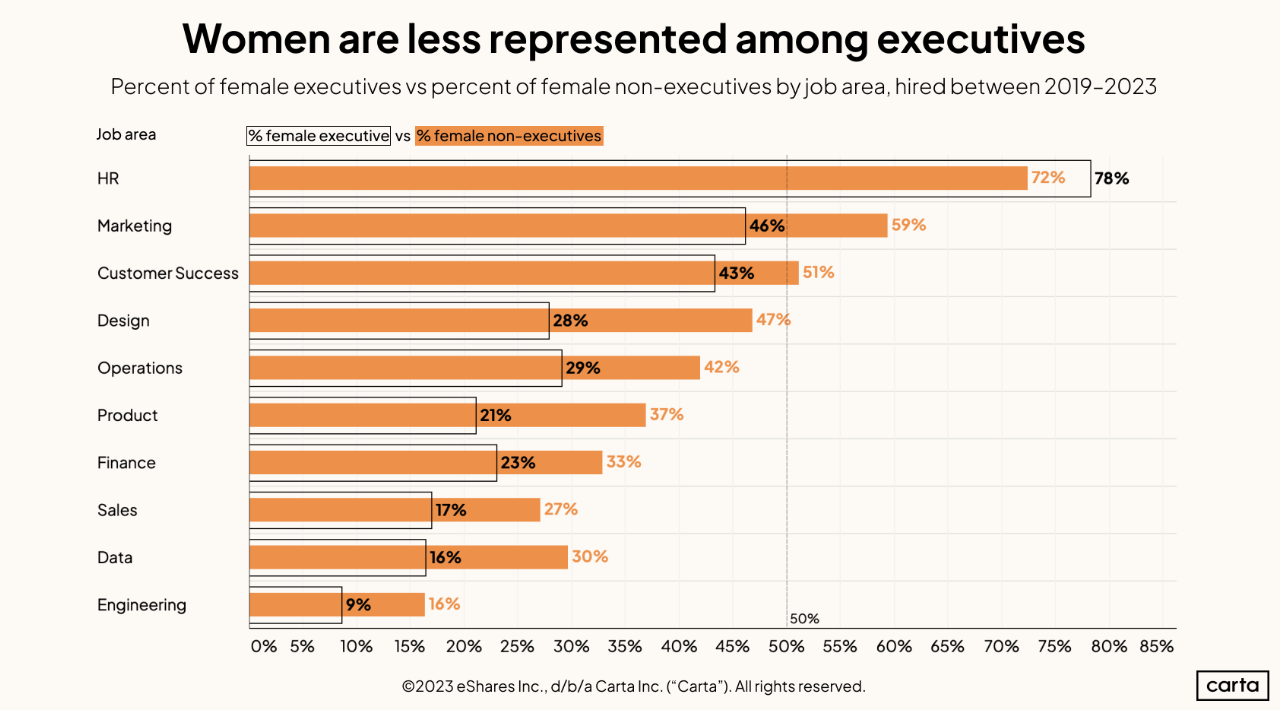

As we know, how much equity women have in a startup, impacts how much wealth they can generate over time. Unsurprisingly, women are less represented as executives in startups where the most equity is awarded. And data and engineering has the least female representation.

Gender:

The proportion of new equity-receiving hires who are women dipped slightly to 35% in 2023, the first annual decline in the past decade. Cumulatively, over the past 11 years, 34% of new hires who received equity are women.

Women and equity:

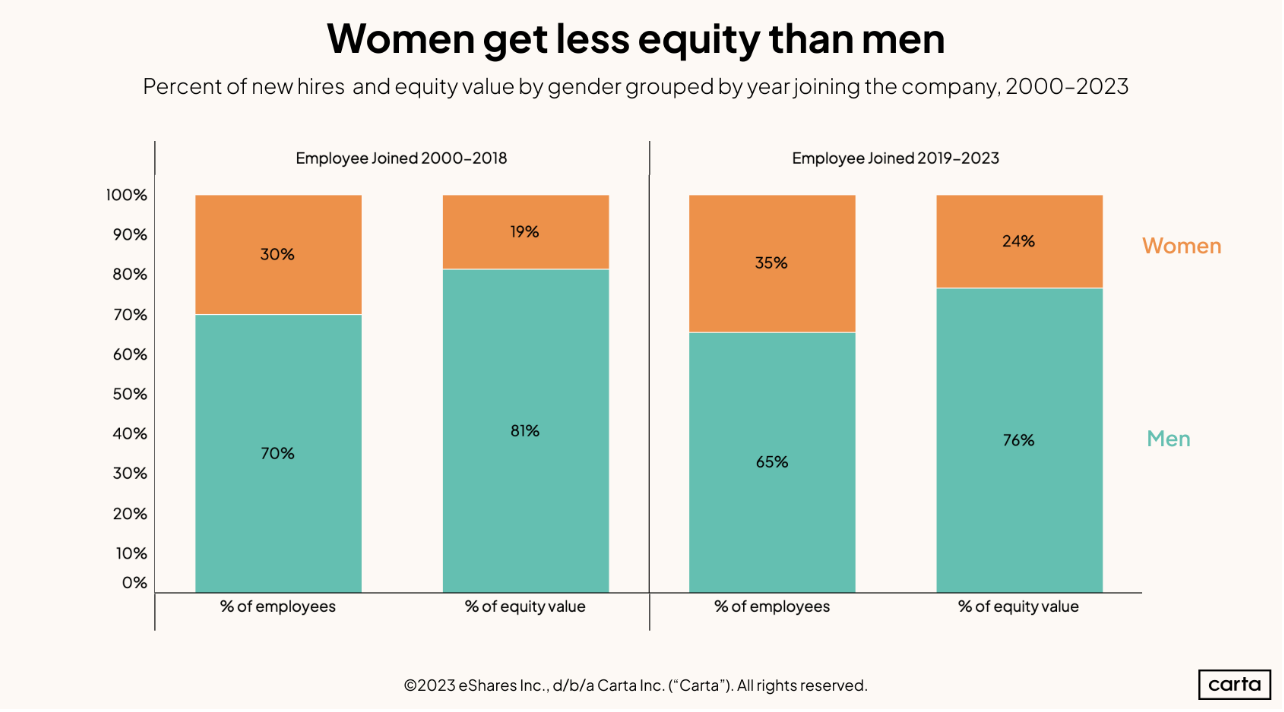

Over the past five years, 35% of new hires who receive equity as part of their compensation are women. But that 35% received just 24% of all total equity issued. On the plus side, the equity gaps between men and women have narrowed over the past five years compared to the previous 19.

Women in senior positions

Among employees in HR hired to non-executive positions in the past five years, 72% are women. In every other major job function, the rate of executive women lags behind the rate of women in non-executive roles.

The gap is particularly stark in the functions where women are least represented in the first place: In both data and engineering, the proportion of women in non-executive roles is nearly twice as high as that of executives.

We know that women in executive positions hire more senior women. And this is also where the most equity is awarded. It goes without saying that women being awarded less equity impacts how much wealth women can earn over time.

Women hires and equity: on the rise (but it is still less than a third)

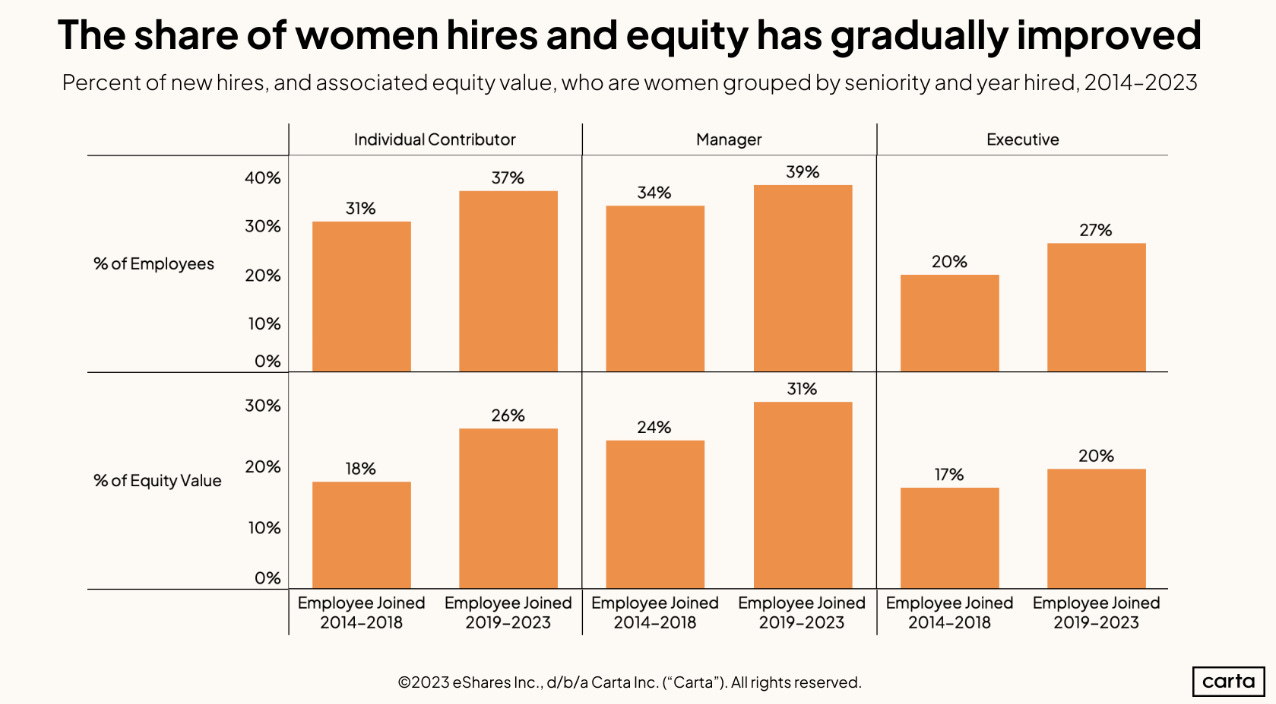

Regarding equity compensation, individual contributors and managers have both seen significant gains, with individual contributors going from 18% of equity received to 26% and managers from 24% to 31%.

Even with those recent gains, however, women are still hired much less frequently than men and receive a much smaller slice of the equity pie.

So what can women do to own more equity in a startup?

Become a female founder and ensure you retain a majority percentage of equity. As you raise funding and give equity away in exchange for a capital injection, this will decline, but women should look to retain control at 50% or above.

Women executives with P&L (profit & loss) experience and responsibility, have greater decision-making power, tend to get paid more and are more likely to negotiate (and be awarded) a bigger slice of the equity pie.

Women who join early or as a co-founder, will have access to more equity than if they join as an employee, a few years after the startup was founded. Timing and risk level often drives decisions about how much equity is allocated.

However it is important to bear in mind, that equity allocation follows existing trends that women, in general, are renumerated (or rewarded less) favourably then men in similar or the same roles. Collect as much data as possible in preparation for your negotiation.

News in Brief

Financial news

China falls deeper into deflation: China’s consumer prices dropped 0.5%, the most in 3 years, a sign the country's economic recovery remains weak.

Japan 10 year yields jump 11bps on policy talk. Head of the Bank of Japan stoked speculation it will tighten its ultra-loose monetary policy.

#India stock value tops $4tn. India added $1tn in market cap in less than 3 years. Key benchmarks are set for eighth-straight year of advances.

US dollar and US yields jump as US November labour market a lot hotter than expected.

Investors beware: ‘Magnificent Seven’ are starting to resemble ‘Nifty 50’ stocks that got crushed in the 1970s market crash.

Jeremy Hunt’s post-Brexit City shake-up is ‘damp squib’, say MPs. Treasury select committee says Edinburgh reforms launched a year ago have had little impact on UK economy.

Peak Big Tech? #Nvidia insiders unload shares after 220% AI rally: Insiders sold or filed to sell about 370,000 shares last mth worth ~$180mln. Zuckerberg sells 1st Meta shares in 2yrs after 172% surge. Meta co-founder unloaded $185m of stock in November.

Crypto: bitcoin, ethereum, DeFi & NFTs

Bitcoin's (BTC) rally halted Thursday and has dipped to $43,000 following its breakneck climb to near $45,000 earlier this week. Experts told Decrypt that the rally was mostly due to hype around the ostensibly imminent approval of the long-awaited spot Bitcoin exchange-traded fund (ETF) product.

Ethereum has popped 5% over the same period and hit $2,372, its highest level since May 2022.

Ether classic (ETC) appreciated 6%, while liquid staking protocol Lido's governance token (LDO) increased by over 11%.

Native tokens of Ethereum scaling networks Optimism and Arbitrum also gained 22% and 9%, respectively, during the day.

Solana (SOL) jumped over 8% to $69, the highest since May 2022, following a three-week cool-off since its mid-November local top.

One meme coin is continuing to explode: Solana-based Bonk. The dog-themed meme coin is now at $0.0000128—a 7-day rise of 188%, and up 635% for the last 30 days.

Fidelity held meeting with SEC about spot bitcoin fund, submitted presentation about ETF workflows.

The Purse Podcast

We cover the following in our conversation with economist Vicky Pryce:

The House of Lords report on the Bank of England inflation failures

What could they have done differently?

The UK economy in review

What's ahead in 2024

Crypto, bitcoin and CBDCs.

Please enjoy! Listen on Apple Podcasts and Spotify+

Coffee Break? Read This

We’d love to hear from you. Get in touch with Jana via the The Purse website or tweet @jointhepurse and janicka.

The Purse Ltd. Copyright 2023 & All Rights Reserved.

Carta report: women and equity in startups. And listen to our podcast interview with UK economist Vicky Pryce